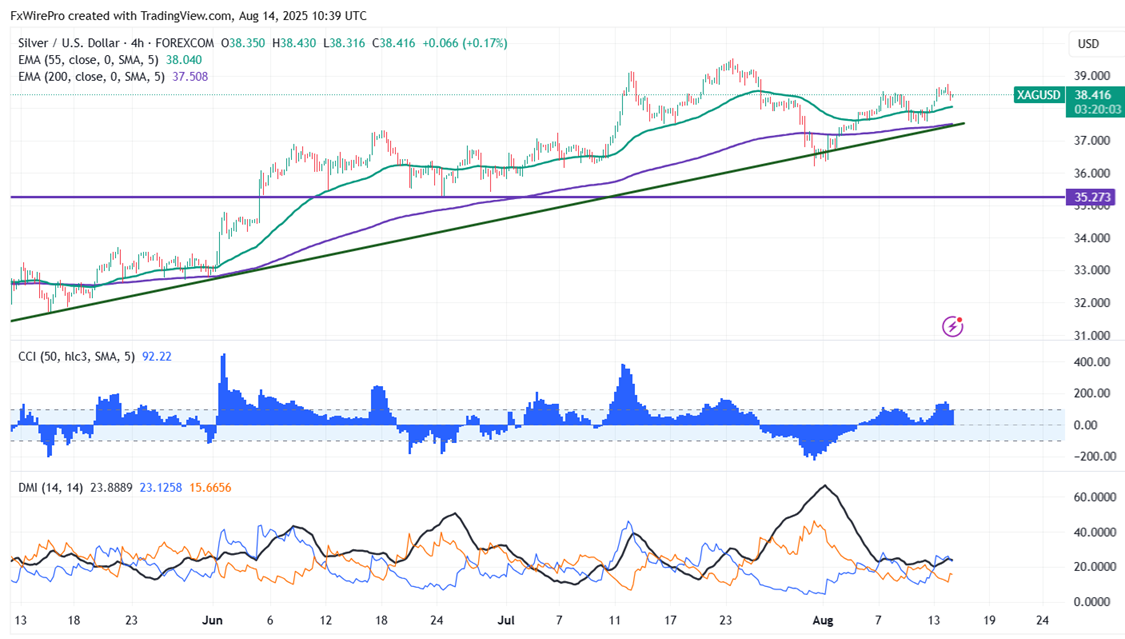

Silver took support near 200-4H EMA and showed a nice pullback due to easing US treasury yields..It hit a high of $38.74 and is currently trading around $38.42.

Dropping about 7 basis points from 4.318% on August 12 to 4.22% on August 14, the US 10-year Treasury yield has shown a noticeable decrease over the two days, reaching its lowest level in a week. Increased market expectations for a significant Federal Reserve rate cut in September, maybe by 50 basis points, strengthened by recent slower inflation and labor market statistics, account for this decline mostly. With the 2-year Treasury yield also falling sharply, reflecting more anticipated monetary easing, the Treasury yields that are decreasing match a weakening US dollar and a shift towards risk assets in international stocks.

Trading Strategy and Key Levels for Silver

The commodity is trading above the short-term (34 and 55 EMA) and long-term moving average (200 EMA) in the 4-hour chart. The near-term support is around $38.15, and any violation below will drag the commodity to $37.78/$37.30/$36.65/$36.17/$35.70/$35.47/$34.80. The immediate resistance is at $38.75; any breach above targets $39.55/$40/$40.45/$41/$41.60

It is good to buy on dips around $38 with a stop-loss at $37 for a TP of $41/$41.60.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary