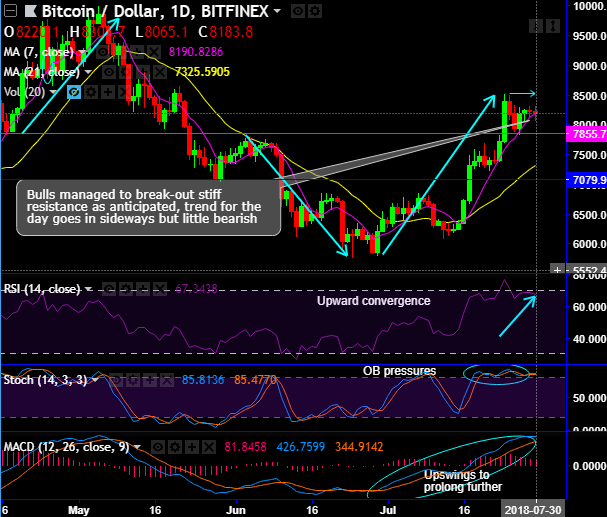

Amid hot news of SEC’s denial of ETF approvals, SEC Commissioner’s disagreement, Winklevoss Explanations and institutional clients’ curiosity for crypto-asset class, BTCUSD is stuck in the narrow range from last two-three days of trading sessions (see above chart).

After Bitcoin’s price spike on the 29th of June which surged from $5,780 to the recent highs of $8,506.7 levels, the sentiments haven’t changed much. However, over the past 24 hours, bearish BTC sentiments are attempting to slide below 7-DMAs again. If you’re perplexed with this type of the price behaviour of the pioneer cryptocurrency trend, then get the clarity from the above-stated regulatory aspects that are driving the price.

The rapid and stratospheric spike of bitcoin prices towards $20K and its jerk to tumble back to $6k level is all a little dizzying and dramatic when CME and CBOE launched and rolled over BTC derivatives.

For now, the clarity of pricing depends on how we interpret the above-mentioned mixed bag of news. The US regulatory agency, Securities and Exchange Commission (SEC) has yet again denied the approval of an application filed by Cameron and Tyler Winklevoss, the reputed cryptocurrency investors and the founders of cryptocurrency exchange Gemini, to launch an exchange-traded fund (ETF) product that tracks the price of bitcoin.

Whereas the Commissioner, Hester Peirce has stated, “her cause of concerns on the Commission’s approach that undermines investor protection by prohibiting greater institutionalization of the bitcoin market. More institutional participation likely to revolutionize many of the Commission’s concerns with the bitcoin market that cause its disapproval order. More generally, the Commission’s interpretation and application of the statutory standard sends a strong signal that innovation is unwelcome in our markets, a signal that may have effects far beyond the fate of bitcoin ETPs (exchange-traded products).”

In reply, Winklevoss Bitcoin Trust, together with CBOE has been striving hard to respond to the U.S SEC’s apprehensions over the market valuation of bitcoin and its volatility as the collaboration (Winklevoss and COBE) has had prolonged BTC-based ETF applications with the U.S SEC for rest of 2018. The SEC, for now, gives approval for the ETF trading just in case a sensational milestone for the cryptocurrency authority is most likely to be established and the price of BTC is likely to be stimulated.

Hence, the famous hedge fund manager, Spencer Bogart of Blockchain Capital proclaimed his forecasts that bitcoin price is staged for the bullish trend in the near future as he reckons that the pullback momentum may have been exhausted due to scepticism on speculations on a possible ETF approval in the near future.

But he foresees a more pragmatic tentativeness in 2019. Nevertheless, he figures out that other feasible alternatives are already in place for both retail and institutional clients into the ecosystem, despite the deferment of SEC’s ETF approval. It is clearly visible that the retail investors are already receiving exposure through crypto-firms like Coinbase, while institutional clients are obtaining access through companies such as Bitwise Asset Management, and Europe already has ETPs.

However, US SEC’s approval of this mechanism would be a stimulant for this industry.

Currency Strength Index: FxWirePro's hourly BTC spot index has shown 129 (which is bullish), while the hourly USD spot index was at -18 (bearish) while articulating at 12:23 GMT. For more details on the index, please refer below weblink:

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty