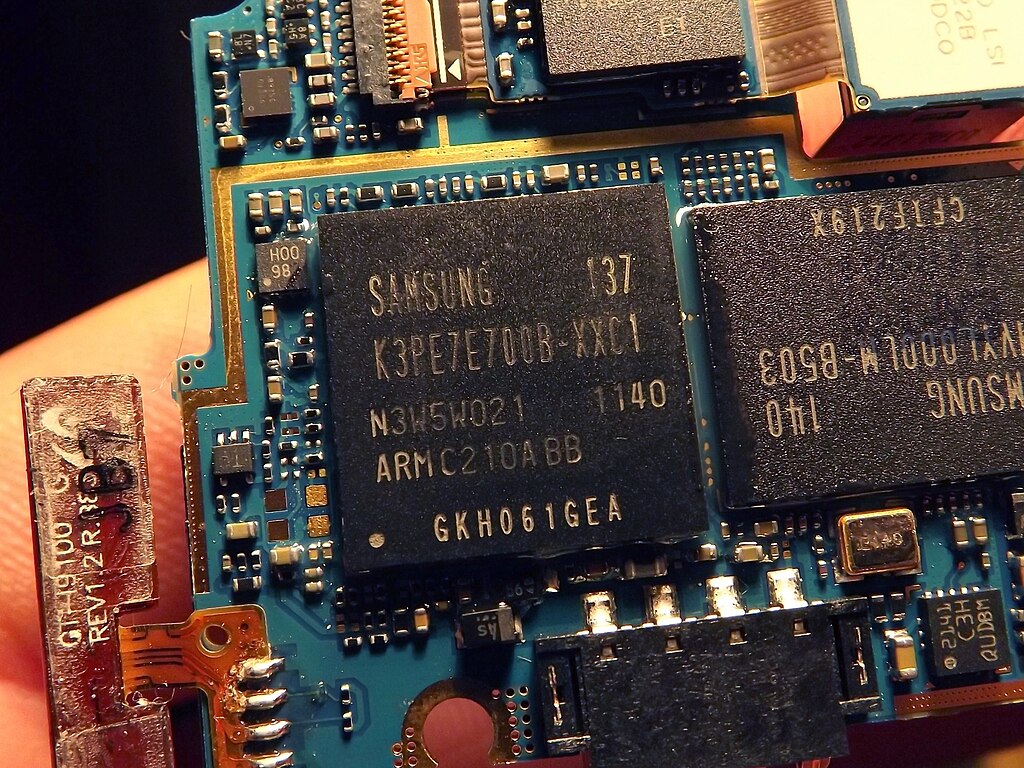

Shares of Samsung Electronics opened more than 3% higher on Monday after the tech giant revealed an ambitious plan to invest 450 trillion won (approximately $310 billion) in South Korea. The investment, set to be rolled out over several years, includes the addition of a major semiconductor production line in the city of Pyeongtaek—home to one of the world’s largest chip manufacturing complexes. The announcement immediately boosted market confidence, reflecting investor optimism about Samsung’s long-term growth strategy and its commitment to strengthening the country’s semiconductor ecosystem.

The new investment strategy comes at a time when global demand for advanced chips continues to surge, driven by technologies such as artificial intelligence, 5G connectivity, cloud computing, and electric vehicles. By expanding its production capabilities, Samsung aims to secure a stronger competitive edge in the global semiconductor market, particularly as rival countries ramp up their own chip-making incentives and supply chain protections. The company’s decision to build an additional line in Pyeongtaek highlights its focus on scaling high-performance chips and next-generation memory technologies, which are crucial for maintaining its leadership position.

Beyond manufacturing expansion, the pledged investment is expected to support research and development, talent acquisition, and strategic collaborations designed to boost national technological competitiveness. South Korea has been actively encouraging private sector investment in chip production as part of its broader effort to become a global semiconductor powerhouse. Samsung’s commitment aligns closely with this national agenda, reinforcing the country’s position as a critical hub in the global tech supply chain.

Investors have responded positively, viewing the investment as a strong signal of Samsung’s confidence in future market conditions. The move underscores the company’s long-term vision to not only meet rising global chip demand but also mitigate risks posed by geopolitical tensions and supply chain disruptions. As the semiconductor industry becomes increasingly vital to global innovation, Samsung’s strategic expansion is expected to play a key role in shaping the future of advanced technology both in South Korea and around the world.

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers

SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates