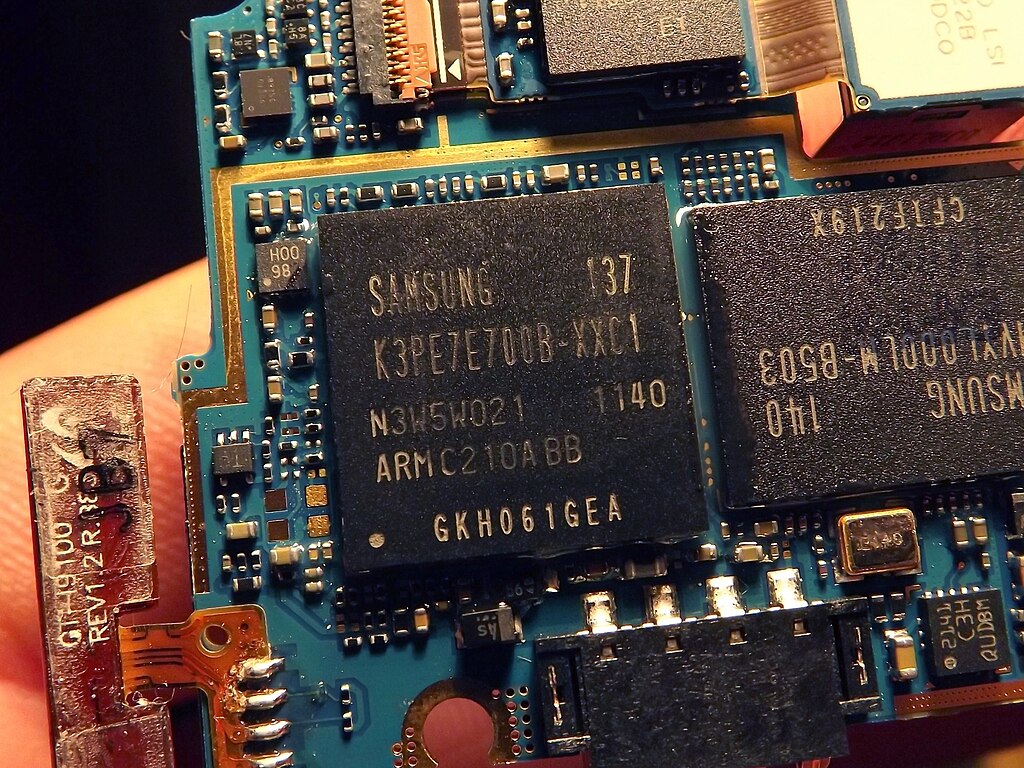

Samsung Electronics posted a 55% drop in second-quarter operating profit as delays in high-bandwidth memory (HBM) chip shipments and U.S. export restrictions on advanced semiconductor sales to China continued to weigh on its core chip business.

The world’s largest memory chip maker reported operating profit of 4.7 trillion won ($3.37 billion) for April–June, nearly matching its earlier estimate of 4.6 trillion won, which had already fallen short of market expectations. Revenue edged up 0.7% year-on-year to 74.6 trillion won, in line with its preliminary forecast.

The ongoing slump underscores growing investor concerns about Samsung’s competitiveness in next-generation HBM chips, crucial for artificial intelligence data centers and used by major clients like Nvidia (NASDAQ: NVDA). The company faces intensifying competition from smaller rivals that have gained traction in the AI-driven semiconductor market.

Adding a potential boost, Tesla (NASDAQ: TSLA) recently announced a $16.5 billion agreement to source chips from Samsung, a deal that could strengthen the South Korean giant’s foundry business, which manufactures semiconductors on contract.

Despite the revenue uptick, prolonged weakness in profitability highlights the challenges Samsung faces in regaining momentum in the rapidly evolving AI and semiconductor sectors. Industry analysts say its ability to accelerate HBM production and navigate U.S.-China export tensions will be key to reclaiming market leadership in the coming quarters.

Samsung’s performance is closely watched as a bellwether for global tech demand, particularly as AI-driven chip competition intensifies across the industry. Investors remain cautious but hopeful the Tesla partnership and potential recovery in chip demand could mark a turning point later this year.

SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz

SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns