Russia is in recession, its longest since 1997, but a collapse is definitely not on the cards. The contraction in Russia's GDP growth accelerated to -4.6% y/y in Q2, from -2.2% in Q1. Monthly data published so far in Q3 imply that the underlying trend in economic activity remains very weak as household spending and investment continue to decline. The IMF's most recent data projects the Russian economy will contract by 3.4 percent this year.

"We expect Russia's GDP to contract by around 4.0% y-o-y this year. While we are still more pessimistic than Russian officials, the Economy Ministry recently revised its 2015 growth forecast to -3.3% y-o-y, down from -2.8% previously", estimates Rabobank.

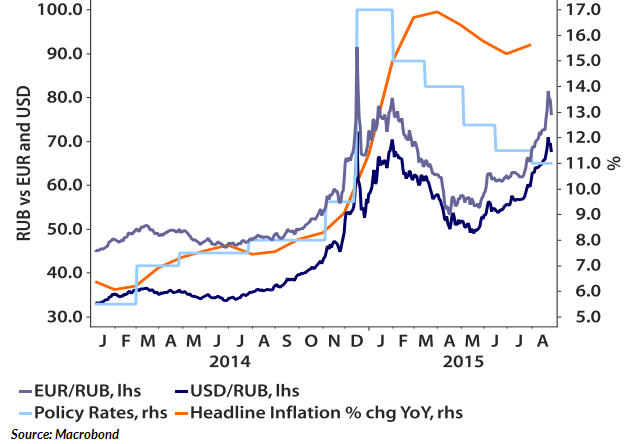

The renewed depreciation of the rouble will not only weigh on the already fragile confidence amongst Russian households, but will also require a far more cautious approach from the Bank of Russia with respect to monetary policy easing. Oil remains the key factor for the rouble in the near term. Russia faces the prospect of low oil prices for longer. Growing concerns about China triggered a rout in commodities with Brent crude plunging to a new year-to-date low at USD 42.23/bbl in August.

"In the coming months Brent crude could revisit the 2008 low at USD 36.20/bbl if we witness more negative signals from China", says Rabobank in research note.

It seems that the sharp fall in the Russian rouble has taken its toll on support for President Putin and the government. Russians are not convinced that the measures announced by officials will prove sufficient as the rouble is once again under severe selling pressure.

Today the Central Bank of Russia held interest rates at 11.00% as expected, and said inflation & inflation expectations showed clear upward trend. The c.bank said it will revise rates based on the balance between inflation risks and economy cooling. It also added that depreciated RUB will continue to put pressure on prices in next few months.

The CBR has cut rates by 600bps so far this year, room for further cuts has narrowed considerably since the July meeting. The main reason why the CBR paused its easing cycle is the rouble. Cutting rates further when there is a risk of even lower oil prices and while global sentiment is very sensitive to any bad news from China, would leave the rouble even more vulnerable against hard currencies.

Following a very impressive start to the year, the Russian currency not only lost its bullish momentum against the US dollar and the euro, but actually weakened to a new year-to-date low in August. The Russian rouble traded weaker early on Friday, tracking oil prices lower. At 1100 GMT, the rouble was weaker against the dollar at 67.99. Brent crude oil, an important driver for all Russian assets, was 1.5 percent lower at $48.2 a barrel.

Russia to face prolonged recession, oil price volatility a key risk

Friday, September 11, 2015 11:27 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary