The services sector of Russia slightly fell during the month of October, yet remaining above the 50-point threshold mark that separates expansion from contraction. However, it continues to point towards a moderate expansion in the sector.

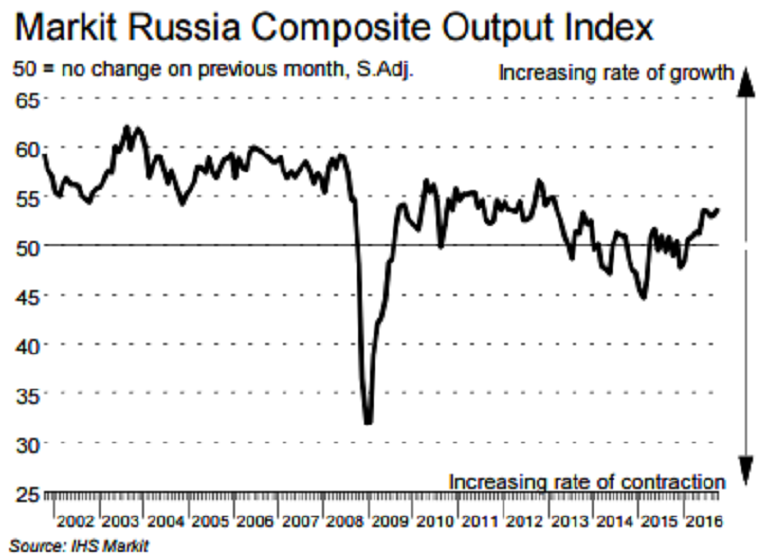

The headline seasonally adjusted Markit Russia Services Business Activity fell to 52.7 in October, slightly down from September’s 53.0. Russia’s Composite Output Index rose to 53.7 in October. The latest figure was the highest for 44 months and indicative of a solid expansion in Russia’s private sector during the month.

The expansion of output was supported by stronger demand for Russian services, as signalled by a further increase in new business levels; the rate of expansion eased to a five-month low and was only modest. The rise was broad-based across sectors, as manufacturers recorded the sharpest increase in new order intakes since March 2013.

Business confidence towards future output levels remained strong amongst Russian service providers in October. However, the level of positive sentiment was weak in comparison to the long-run series trend. Russia’s manufacturing industry registered greater inflationary pressures during October. Moreover, the rate of cost inflation continued to outstrip the rise in selling prices.

Meanwhile, job shedding continued both at Russian service sectors as well as manufacturing companies, despite the reported rise in outstanding business. Job cuts have been evident in each of the past two months at service providers, while the latest decline was the sharpest since May.

"Softer increases in new business and incomplete work levels weighed on the performance of the service sector, while firms maintained their current job shedding policies. However, the performance of the sector is still stronger in comparison to the 2016 average, thus leaving it well placed to experience a solid fourth quarter of growth," said Samuel Agass, Economist, IHS Markit.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady