Ripple’s Institutional Surge: XRP Eyes $5 Amid Regulatory Clarity and Whale Activity

Institutional Momentum and Regulatory Breakthrough

Driven by the resolution of regulatory uncertainties and the rapid adoption of institutions, September 2025 marked a turning point for Ripple and XRP. With a historic judgement confirming that XRP is not a security in secondary market transactions, the legal dispute between the SEC and Ripple ended in March 2025. clear large regulatory obstacles and open the path for institutional involvement. With this clarity, the first U.S. spot XRP ETF—the REX-Osprey XRP ETF (XRPR)—launched successfully, reaching an astounding trading volume of $37.7 million on its first day. Particularly, the innovative cooperation with BlackRock, combining Ripple's RLUSD stablecoin with prominent investment funds and strategic partnerships, further reinforced XRP's institutional position. Ripple's application for Direct Federal Reserve payment infrastructure access prepares the firm through national trust bank charters with the OCC.

Market Performance and Prospective Catalysts

Reflecting a great 385% rise over September 2025, XRP showed strong market momentum, currently trading between $2.86 and $2.87 with solid support set at $2.80 levels. Last year's $161 billion market value propelled it back into the top 100 worldwide assets by capitalization. While exchange holdings dropped almost 90%, major whale accumulating activity was obvious, including single purchases of 17.5 million XRP ($48.9 million) and combined purchases of 30 million XRP ($86 million). Looking forward, several catalysts set XRP for ongoing expansion, including six open ETF applications with October 2025 approval deadlines, XRP options debuting on CME Group On October 13, 2025, and Ripple's growing real-world usefulness through its On-Demand Liquidity service, handling $1.3 trillion in Q2 2025. Experts predict possible price targets. ranging from $5 to $22 over extended timeframes, some expect $7 to $30+ by 2026, depending on ongoing institutional acceptance and the convergence of legislative support, technological improvements, and more usage in the worldwide financial system.

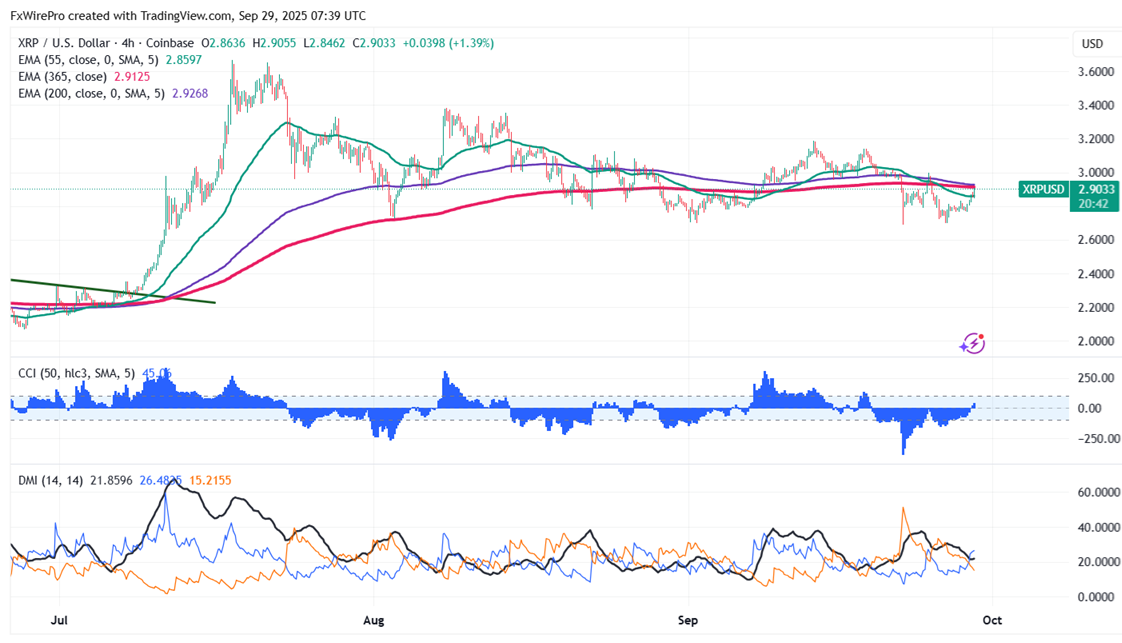

Resistance and Support Analysis

XRPUSD pared some of its gains following the footsteps of BTC. Immediate resistance level for XRP is around $3, and a breakout above this level will push prices higher to $3.40/$4/$5. Any breach above $5 confirms further bullishness, a jump to $7. On the downside, immediate support lies at $2.60 any break below targets $2.25/$2/$1.60, $1.27, $1.00, $0.85, and $0.74.

CCI(50)- Bullish

Directional Movement Index - Bullish

Trading Strategy Recommendation

It is good to buy on dips around $2.60 with SL around $2 with SL around $4/$5.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary