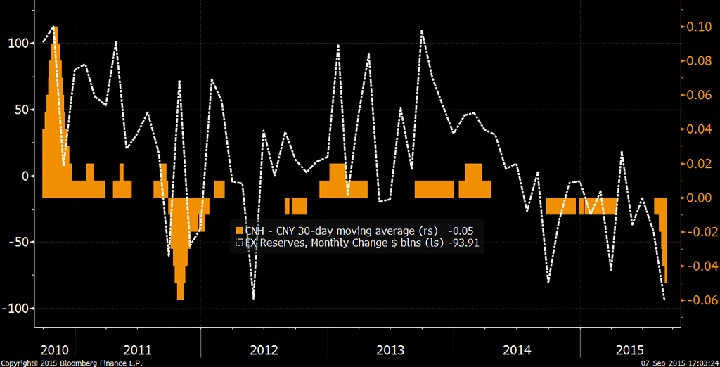

China's gigantic forex reserve, fell by $94 billion in August to 3.56 trillion (approx.), lowest level since 2013.

On August 11th China depreciated onshore Yuan via fix (trading mid-point released by Peoples Bank of China just before trading opens) by 1.9%, biggest devaluation in more than two decade. Beijing continued three days of consecutive devaluation.

Officially PBoC has said this move is a onetime effort, which takes into account FED's interest rate hike policy and the value of fix will now take into account CNH closing as well as changes in major currencies.

What many analysts (including us) argues that it actually was is a defacto peg break. PBoC incurring heavy cost to hold the Yuan/Renminbi around 6.2 against Dollar amid capital outflow, so devaluation was PBoC's effort to release some of the pressure and not to sell Dollar cheap.

Latest report on reserves provide evidence of such.

In spite of the devaluation, (according to us, due to the devaluation) PBoC is still experiencing heavy capital outflow pressure thanks to unwinding in short term position (Yuan isn't one way trade). In spite of its positive trade balance and FDI flows, sharp fall in FX reserves suggest heavy intervention by PBoC and capital flight. It could be somewhere between $110-120 billion.

Expect further capital flight, more the reserves bleed and depreciation, greater will be the pressure.

If not convinced, have a look at the widening spread between onshore and offshore Renminbi. Offshore Yuan is now trading at a considerable discount suggesting further capital flight continuation in September. While onshore Yuan is trading at 6.36 per Dollar, offshore is trading at 6.48 per Dollar.

Have a look at history, chart courtesy Bloomberg.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings