Mega announcement for the year is finally done with, as board of International Monetary Fund (IMF) took decision in its review, to add Chinese currency, Yuan or Renminbi in its Special drawing Rights (SDR).

This is a milestone decision, since it is the first currency addition in SDR basket in last 35 years, except for replace Franc and Mark with Euro back in 1999,

Going forward, over next decade, the impact will not only be felt in financial markets but to global trade, as well as geo-politics.

In previous parts, named Renminbi series: Yuan into SDR, we discussed general facts on SDR and Yuan's probable inclusion in the basket, near term possibilities of the addition and why it's a done deal. We also discussed in our view what could be the weightage of Yuan in the basket (we were close but not accurate enough.

Previous composition

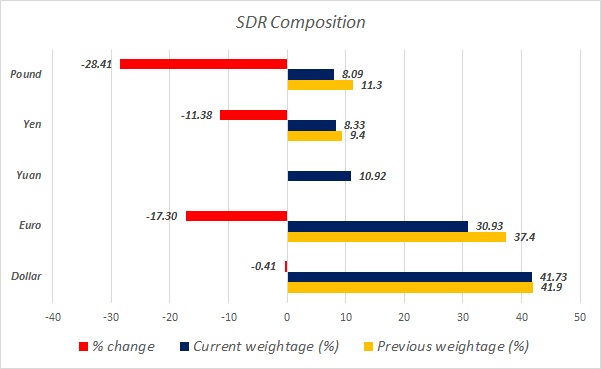

As of last basket, highest weightage is given to Dollar (41.9%), followed by Euro (37.4%), Pound (11.3%) and Yen (9.4%).

Market chatter

After staff recommendation report, some talks in the market suggested that weightage given to Yuan could be as high as 14%, surpassing both Yen and Pound.

Our idea -

We expected, Yuan to beat Yen but not Pound in weightage and the weight to be somewhere between 9-10%. Expected Euro and Yen's weightage to decrease most.

Actual composition

As of final basket, highest weightage is again given to Dollar (41.73%), followed by Euro (30.93%), Yuan (10.92%), Yen (8.33%) and Pound (8.09%).

This new composition will become effective from next year onwards. While long term impact could be immense, there has hardly been fireworks in the short run.

China's benchmark stock index is up 0.3%, while onshore Yuan is flat at 6.399.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX