Last year marks not only weakness in China's exchange rate but also some crucial reforms/change in approach while setting its exchange rate. In August, People's Bank of China (PBoC), not only forced devalued Yuan for three consecutive days, which resulted in heavy market turmoil, it also said that it would be giving market greater voice , while setting up the daily fix, central point of 2% volatility band.

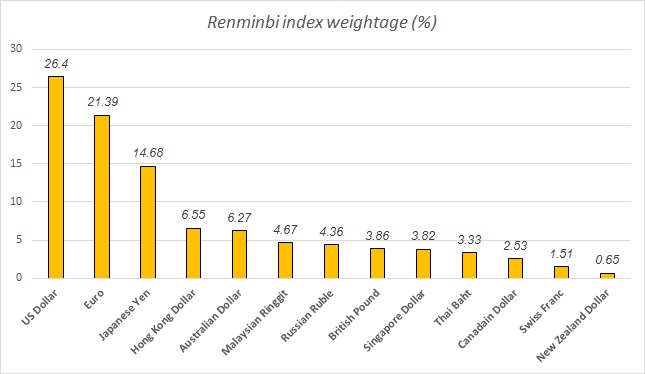

Later that year, China introduced a new launched Renminbi Index, similar to US Dollar index, whose value would be derived from 13 different currencies.

We, expect the aim of Chinese authorities and PBoC to shift the Yuan linkage from current Dollar based regime to Renminbi index based, making the Yuan more broad based.

However, China's linkage to Renminbi index, could pose problem to some global central bankers.

This theory is based on the notion that due to China's large export setup, weak Renminbi may not be other exporters' interests.

So, in current Dollar based regime, policy based move in Euro or Yen hardly have any effect on Yuan but under Renminbi index regime, if European Central Bank's (ECB) policy depreciated Euro by 10%, it would have large effect on Yuan exchange rate. With all other exchange rates being equal Yuan could drop to as low as 7 per Dollar to keep the index stable.

It is important to note, though all this discussion is theoretical, but further shift I policy approach remains practical and could very well be source of some further uncertainty.

Yuan is currently trading at 6.6 per Dollar in offshore market.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX