'Impossible Trinity/Trilemma' is an economic concept which suggests that a country can’t all the three following at the same time; a fixed foreign exchange rate, free capital movement, and an independent monetary policy. And the ‘Trinity’ is back to haunt China again and this time around it has more firepower.

Why we say, ‘firepower’?

Simply because, this is not the first time China has faced the challenges of the impossible trinity and every time the country’s central bank (People’s Bank of China) has cleverly maneuvered its policy to avert the ‘Trinity’ disaster, which usually gets triggered by sudden explosion of volatility with either peg break or rise in the interest rates. However, every time, as China continued growing at a rapid pace, countering the Trinity under modernization and fixed exchange rate regime became difficult.

Brief history:

Due to these increasing challenges and to modernize its financial system, China de-pegged its currency from the U.S. dollar back in 2005 and since then it has gradually opened its economy to the world and reduced control over the capital account. However, PBoC still controls the volatility of the USD/CNY exchange rate by announcing a central point and the exchange rate is allowed to move within 2 percent band

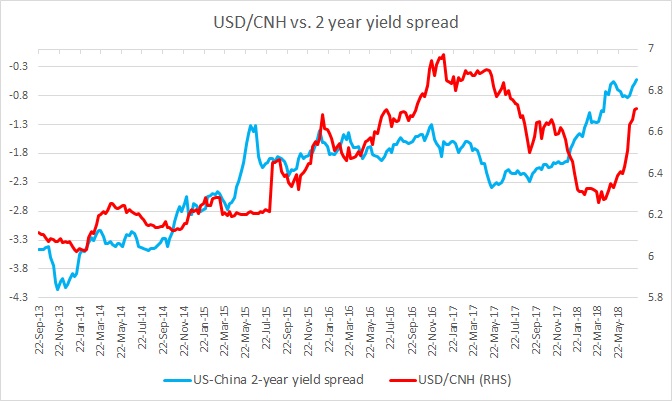

In modern day’s China counters the trinity using its vast foreign exchange reserve from time to time but recent history suggest that it is becoming increasingly difficult for the $11-12 trillion economy to counter the ‘Trinity’. In the above chart, look around March-August 2015 area, and you would see from the exchange rate movement that it was managed by PBoC, whereas the rate differential between the U.S. and China moved sharply in favor of the USD. After refusing to let the Yuan depreciate for several months, PBoC finally had to announce a one-time devaluation of the Yuan, leading to the biggest intraday selloff in the stock markets around the world.

Since the event, PBoC has further reduced its intervention in the foreign exchange market for a prolonged period.

The challenge now:

The figure above clearly suggests that the interest rate spread between China and the U.S. govt. bonds are in decline with the United States firing its all engines of growth and the U.S. Federal Reserve raising interest rates in response to a growing economy with the higher inflation rate.

It is happening at a time when the current U.S. administration has waged a war against China’s massive goods’ trade surplus with the United States, which reached $375 billion in 2017.

With the U.S. rates likely to increase further, the PBoC would either have to let the domestic interest rates rise, or let the yuan to depreciate based on market expectations.

We don’t expect the central bank, which has cleverly countered the trilemma over the decades to move aggressively and challenge. FxWirePro’s money is on letting the exchange rate depreciate as it would automatically counter some impacts of tariffs.

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal