Any unanticipated disruption by Fed's rate policy should not puzzle the strength registered from last fortnight or so, thus in order to play it safe below options strategy is recommended.

The zero-cost collar is recommended on verge of surge in the dollar also.

Intraday price band: 1192.57 on north range - 1186.59 on south range, although we are upward bias, overpriced sentiments are boiling as oscillators suggest overbought pressure.

Hence for now ATM binary puts on every price rise are recommended.

Short-medium term price band: 1195.55 on north range - 1170.15 on south range.

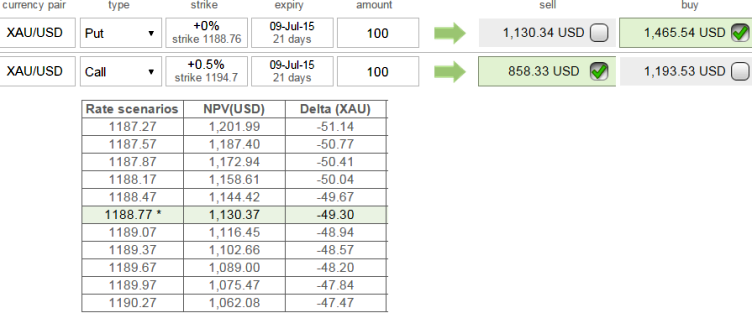

Option Strategy: Collars on XAU/USD

The execution is has to be by buying At-The-Money (strike at 1188.70) 0.5 delta put option while writing 21D (0.5%) OTM covered calls (strike at 1194.70) with +ve theta value.

The strike price at which the premium received, should contribute more than 50% of the cost of premium of the protective put (see diagram i.e US$ 858.33).

Reduced-cost collars for bullion bulls

Thursday, June 18, 2015 7:50 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?