The recent rise of Chinese technological brands at the expense of a wide range of small players in Europe, US and Asia, could possibly reinforce foreign concerns about Chinese competition in the global tech sector, according to the latest report from DBS Group Research.

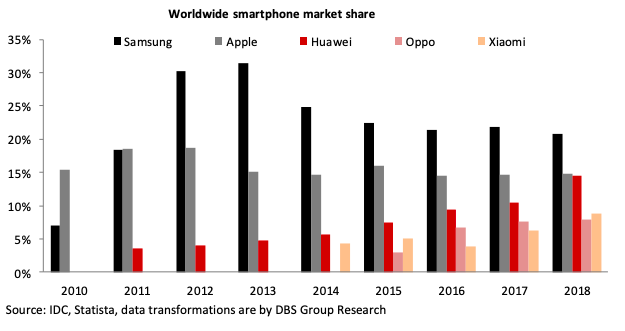

Chinese firms have been growing rapidly in the smartphone sector. Huawei boosted its global market share to 14.6 percent in 2018 from 10.5 percent in 2017, on par with Apple’s 14.8 percent; while Oppo and Xiaomi have gained in the last 2-3 years.

Chinese brands account for more than 40 percent of global smartphone shipments today, far exceeding Samsung’s 21 percent. The decline of Samsung started from 2014, well before the deterioration in South Korea-China political ties and the Chinese boycott of Korean products in 2017.

The decline of Apple started from 2013, also far before the US-China trade war broke out. The advancement of Chinese smartphone makers is not new and has been ongoing for many years, which could be attributed to the structural factors such as technology/product maturity, price competitiveness and marketing success.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January