As expected, the RBNZ left the OCR unchanged at 1.0% at today's OCR Review.

The press release suggested that the RBNZ does not currently see a need to cut the OCR further. The overall assessment was that the outlook for monetary policy "has not changed significantly" since the August MPS. The RBNZ seems to be saying that its actions to date are sufficient. It noted that the OCR cuts to date have led to lower lending rates and a lower exchange rate; and, it expected low-interest rates to generate a pickup in domestic demand over the coming year.

The RBNZ did say that there was room to cut further "if required." We interpret this as an easing bias rather than a signal. In other words, the RBNZ views a cut as more likely than a hike, but is not committing to either at this point.

The Kiwis central bank has demonstrated its willingness to take bold steps, which means markets are likely to remain dovishly positioned for some time. As discussed in our recent posts, we now think the odds favor the further RBNZ rate cut the OCR to a new low of 0.75% in November. Combined with easing from other central banks, that should push NZ swap rates to fresh record lows.

Hence, we reckon that the prevailing rallies of NZDJPY are momentary, NZD is expected to depreciate towards 65 levels by year-end.

The global risks are reckoned to play less conducive for NZ than they do for Australia, and the central bank has reason to be credibly dovish even as the data have outperformed some of the downside risk scenarios laid out earlier in 2018. The pair is forecasted to depreciate below 65 levels by year-end.

While the NZDJPY trade is underwater following positive news reports on a US-China agreement. The erratic nature of news flow is one reason why we had suggested NZDJPY shorts via options in the past, suitable options strategy is designed favoring the bearish side.

OTC Updates, Trade, and Hedging Recommendations:

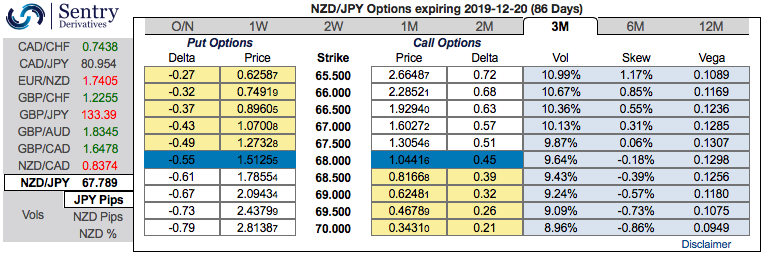

3m IV skews are right indications for NZD that have clearly been indicating bearish risks. The major downtrend continuation shouldn’t be panicked the broad-based bearish outlook amid minor rallies.

The positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes up to 65.500 levels (refer above nutshells evidencing IV skews).

Hence, initiate longs in -0.49 delta put options of 3m tenors, simultaneously, short (1%) out of the money put options of the narrowed expiry (preferably 2w tenors), the strategy is executed at net debit.

Well, a higher (absolute) Delta value is desirable on the long leg in the above-stated strategy. Whereas, the Theta is positive on the short leg; as the time decay is good for an option writer (that’s why we’ve chosen narrowed expiry). The short side likely to reduce the cost of hedging with time decay advantage on the short leg, while delta longs likely to arrest potential bearish risks.

Alternatively, shorts in the mid-month futures have already been advocated with a view of arresting the downside risks. We wish to uphold the same short hedge strategy of mid-month tenor that was advocated in our previous post.

One can also buy tunnel options spreads with upper strikes at 68.188 and lower strikes at 67.207 levels on the trading grounds. Courtesy: Westpac & Sentrix

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis