President Joe Biden has ordered the removal of a Chinese-owned cryptocurrency mining company from land near a Wyoming missile base, citing national security concerns. The directive targets MineOne Cloud Computing Investment and its partners, requiring divestment within 120 days.

Biden Cites National Security Concerns in Order to Remove Chinese-Linked Crypto Miner Near Missile Base

In a recent report by Cointelegraph, U.S. President Joe Biden has signed an order prohibiting a China-linked cryptocurrency mining company from using land near a Wyoming nuclear missile site.

The directive, issued by the White House on May 13, requires MineOne Cloud Computing Investment and its partners to divest land used as a cryptocurrency mining facility near the Francis E. Warren Air Force Base in Cheyenne, Wyoming.

Biden justified the order to terminate the firm's property rights by citing national security concerns.

“There is credible evidence that leads me to believe that MineOne Partners Limited, a British Virgin Islands company ultimately majority owned by Chinese nationals [...] might take action that threatens to impair the national security of the United States.”

MineOne purchased the property in June 2022 and improved it for cryptocurrency mining near the Air Force base. The order stated that the military site is a strategic missile base that houses intercontinental ballistic missiles.

The corporation and its affiliates are also expected to remove all equipment on the site following the renovations. The injunction also forbids Chinese-linked entities from gaining further access to the location less than a mile from the base.

The corporation has 120 days from the date of the order to sell the property and may not transfer it to third parties. Computer giant Microsoft has previously raised red flags about this site, which operates a data center nearby.

CFIUS Report Cites Security Risks of Chinese Crypto Miner Near U.S. Missile Base, Highlights Role of Foreign Investment Scrutiny

According to a 2023 New York Times investigation, the location may allow the Chinese to "pursue full-spectrum intelligence collection operations," as the Microsoft team stated in an August 2022 report to the Committee on Foreign Investment in the United States (CFIUS).

Treasury Secretary Janet Yellen, who also chairs the committee, stated that the ruling requiring MineOne to sell the land "highlights the critical gatekeeper role that CFIUS serves to ensure that foreign investment does not undermine our national security."

MineOne generated over $20 million for their first fund in just one month in 2021. According to the release, the fund has been "actively subscribed" to by U.S. institutional investors and high-net-worth individuals since its inception in October 2021.

Cointelegraph contacted MineOne for comment but has yet to receive an instant answer.

The Biden administration had earlier ordered a crackdown on the U.S. As part of its continuous battle on cryptocurrency, the Bitcoin mining industry has cited China as an example to emulate.

The Chinese government severely restricted cryptocurrency mining in 2021, sparking an exodus of mining enterprises, many of which ended up in the United States.

The latest White House decision comes only one day before the Biden administration plans to substantially raise duties on several Chinese products, including electric automobiles.

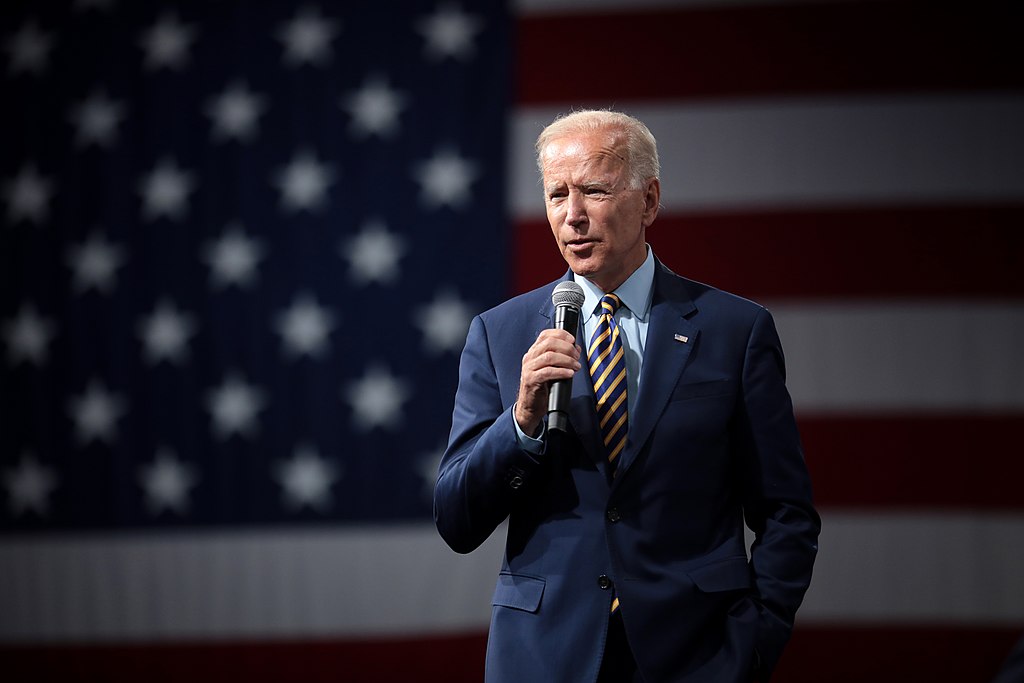

Photo: Gage Skidmore from Peoria, AZ, United States of America, CC BY-SA 2.0, via Wikimedia Commons

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services

Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report

Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report