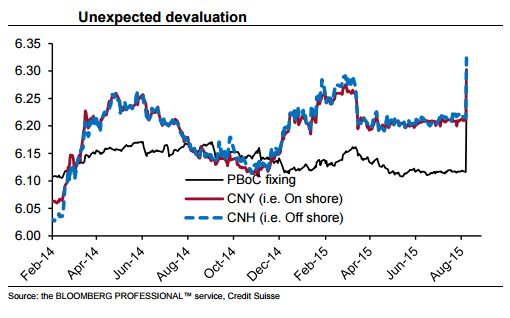

The PBoC has lifted the daily USD/CNY exchange rate fixing to 6.2298 - an 1.86% devaluation compared to the fixing of 6.1162 on 10 August. The move was in response to the very weak exports in July and the broad-based slowdown in overall demand. In a dollar strengthening environment, CNY has appreciated against the trade-weighted basket by more than 3.5% in 1H15, according to data from the Bank for International Settlements (two standard deviations above the underlying trend).

The PBoC may be in the process of bringing the exchange rate closer to the underlying trend of the trade-weighted currency basket benchmark. This also looks like a pre-emptive move, ahead of the interest rate hike from the US Federal Reserve and potential further dollar strength.

"We do not rule out smaller actions in the coming weeks. However, we do not believe that China will engineer a big devaluation, or a few consecutive devaluations, in an attempt to boost exports," notes Credit Suisse.

It would take a much bigger change to ease the pressure on exporters, but that is not on the decision makers' high priority list. A key concern for the PBoC is that outsized exchange rate devaluation could trigger capital flight.

PBoC devalues the CNY by 1.9%

Tuesday, August 11, 2015 11:32 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX