Last year while Bank of Japan (BOJ) announced it will increase asset purchase to ¥ 80 trillion per annum, Japanese Pension fund GPIF, which is the biggest in the world decided to allocate 25% of its assets to domestic equities, while reducing its holdings of Japanese government bonds.

Over these news Japanese equity market rallied sharply, Nikkei jumped from 15000 area in October to close to 21000 in August.

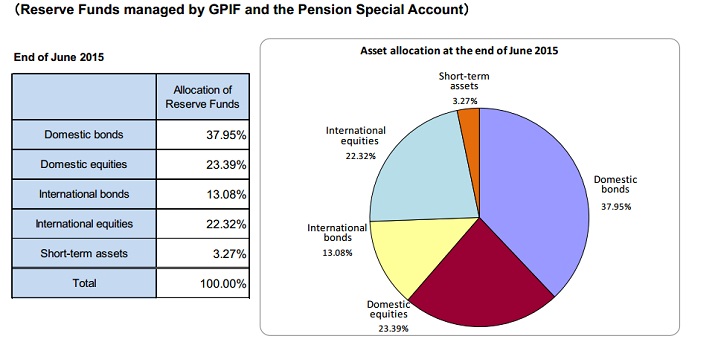

GPIF has assets worth 1.17 trillion dollars, and 25% of that means about $260 billion.

As of latest report from GPIF, it has allocated 23.4% of the funds to domestic equities by June and probably done with 25% by now.

Japanese equities are likely to face tougher times with its big buyer gone.

Nikkei future is currently trading at 17638, down more than 15% from its recent peak in August.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings