Headwinds to global demand, coupled with lower oil prices and generally negative Emerging Markets sentiment are likely to keep pressure on the Mexican peso in 2016. Although MXN is somewhat cheap compared with its long-term fair value, the above mentioned factors justify the short-term undervaluation. The risk to further weakness still persist, although moderately so.

Price pressures in Mexico are still falling, with CPI inflation of only 2.2% y/y in November. The inflation print for December will be released on Thursday, and it is definitely not expected to be a market driver. The data will likely confirm that inflation remains very low and close to 2%, way below the target. This does not make a compelling case for aggressive tightening by Banco de Mexico, which is at this point closely tied to the Fed's policies.

"We expect a slow convergence to 3% during the next year, giving Banxico ample space to remain accommodative", says Barclays in a research note.

In Brazil, continued adverse fiscal developments and increased political uncertainty will continue to weigh on recovery and the country will likely remain as one of the worst LatAm performers. Brazil's economy is forecasted to contract by 2.81 pct in 2016 after contracting by 3.70 percent this year, the biggest drop in 25 years. Standard & Poor's and Fitch Ratings have downgraded Brazil's sovereign debt to junk in the recent months.

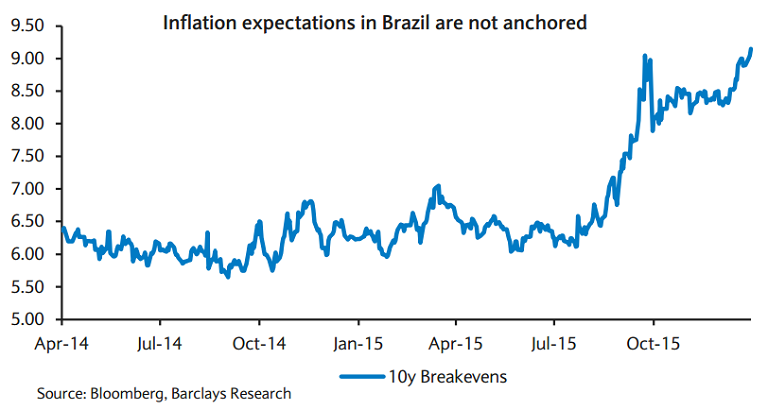

The destruction of potential output will only make the stabilization of the debt/GDP path more difficult. Hence, the probability of monetization should continue to increase, pushing inflation expectations up and weakening the BRL. Brazil inflation data for December will be released on Friday, which should be close to 11% if the market consensus is accurate (10.77%).

"Although analysts acknowledge the dilemma that the central bank faces, given the de-anchoring of inflation expectations, we do not think that it will be able to deliver as many hikes as currently priced in the DI curve", adds Barclays.

Brazil's rough 2015 is reflected in the real's nearly 33% slide against this dollar this year. The next monetary policy meeting will give us more light, but a shallower tightening path would weaken the BRL further. USD/MXN was trading at 17.3656, while USD/BRL was at 4.03 as of 1151 GMT.

Oil, inflation and politics to drive MXN, BRL price action

Monday, January 4, 2016 12:14 PM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary