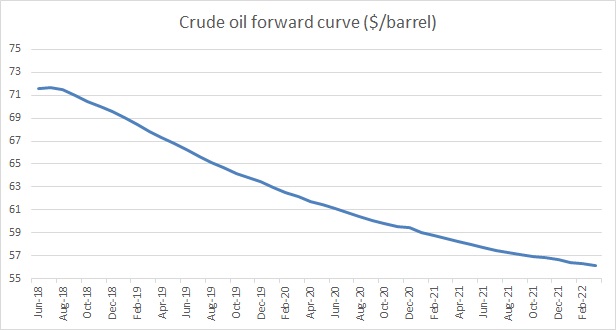

The above chart is the crude oil forward curve, which clearly shows that the market is pricing lower crude oil price going ahead. And it is at a time when the market is buzzing about supply concerns stemming from Venezuela due to its dwindling production and Iran thanks to looming U.S., sanctions on the country. It is also at a time when the talks of the moment are geopolitical tensions, OPEC agreement, and higher demand, which was the result of the lower oil price.

So, why the forward curve is pricing that higher oil price won’t stay for long?

If you can remember the days of 2014/15/16, when the price of oil was going down sharply, you might remember why the price was going down. It was shale oil. The new technology of horizontal fracking was rapidly giving rise to the production in the United States, which is still rising and reached a new record high of 10.72 million barrels per day.

This time around, the oil’s fight is with new advanced technology, which would shape the future of the oil market. It is fact that the United States isn’t the only country with shale oil reserves and it is inevitable that other countries would use the technology to shore up production.

At the same time, as the energy industry landscape changes, we expect the natural gas and renewable energies to impose greater challenges to crude oil going ahead. The present higher oil price (Brent at $80 per barrel) would only fasten the shift to the next generation fuel.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022