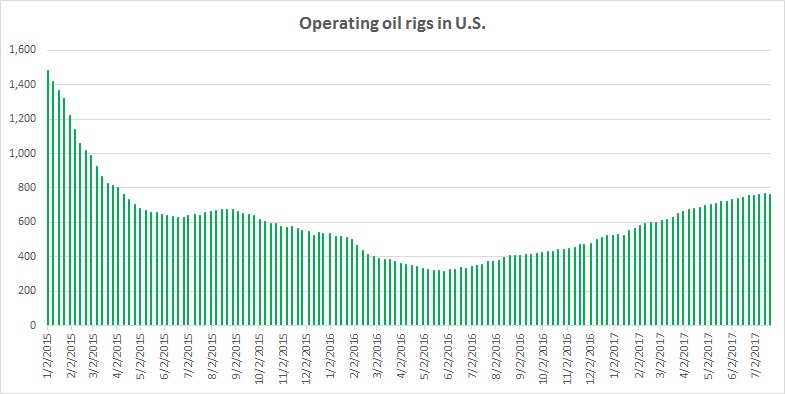

Last week’s report from Baker Hughes shows that operating oil rigs declined for the second time in 27 weeks. The increasing numbers of operating rigs, as well as increasing production, have been raising concerns that the U.S. shale oil producers which were able to cut their production cost dramatically over the past years are now a low-cost global competitor and would continue to undermine the OPEC agreement to cut supplies. In May, OPEC producers and 11 participating non-OPEC countries including Russia formally ratified the agreement first drafted last November to cut supplies by 1.76 million barrels per day for an extension. The new agreement extends the production deal for nine months until March 2018. However, the latest oil market report from OPEC showed that production increased by 396,000 barrels per day in June, after rising by 366,000 barrels per day in May, thanks largely to two exempted countries, Libya and Nigeria.

Despite the agreement, the oil price has suffered a major selloff on the day of the agreement and was down around 3 percent by the end of the day. Despite the recent week’s rise in price, the oil is down more than 11 percent since the agreement. In the first half of this year, crude oil price declined by around 15 percent, which is its worst H1 showing in 19 years. The North American benchmark WTI is currently trading at $45.8 per barrel and Brent at $2.3 per barrel premium to WTI. The increased production in the U.S. and an increase in the numbers of operating rigs remain as one of the biggest of concerns for the oil bulls.

The report from Baker Hughes shows that the numbers of operating rigs in the United States declined for the 2nd time in the last 27 weeks. In last week, there was a decrease of 1 operating rigs in the US, pushing the total number to 764, the highest since April 2015. A separate report showed that U.S. oil production recovered to 9.43 million barrels per day, which is the highest level of production since August 2015, however. The production has increased by more than a million barrels per day since bottoming around last July. The International Energy Agency (IEA) recently forecasted that production is set to rise by 920,000 barrels in 2017 alone and by 780,000 barrels per day in 2018. So far, this year, production has increased by 730,000 barrels per day.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed