The International Energy Agency (IEA) released its monthly oil market report. The report suggests a well-supplied oil market. Here are the key highlights,

Global supplies:

- Global oil supplies declined for the third consecutive month in January. It declined by 1.4 million barrels per day thanks to new OPEC agreement and product cuts in Canada’s Alberta after declining 0.95 million barrels in December and 360,000 barrels per day in November on a monthly basis.

- According to IEA, oil supplies have risen fast over the last year but recently started coming down.

- IEA expects non-OPEC supply growth to slow down to 1.9 million barrels per day in 2019 after a record gain of 2.7 million barrels per day in 2018. The figures are higher than December when IEA forecasted 1.6 million barrels growth. The revision is largely due to higher U.S. production.

- Global supplies are higher than last year by 2.7 million barrels per day, as of December.

OPEC supplies:

- According to IEA’s calculations, OPEC production was 30.83 million barrels per day (4-yr low) in January, down 0.93 million barrels from December as Saudi Arabia, UAE, and Kuwait reduced production, while Venezuela and Libya saw production dwindle thanks to geopolitical uncertainties.

- According to IEA, compliance with the new OPEC agreement has hit 86 percent.

Global demand:

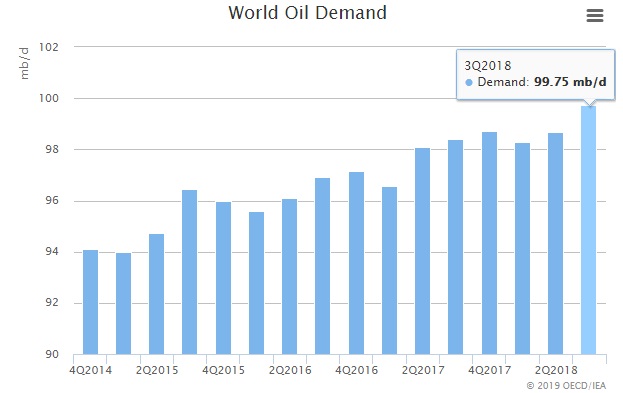

- IEA maintained its global oil demand growth forecast at 1.4 million barrels per day for 2019. IEA expects that a weaker oil price would compensate for the weaker economy. IEA expects new petrochemical projects in China to provide support demand growth, while weaker demand from the U.S. would keep things checked.

- The majority of the demand growth is expected to come from emerging markets. However, growth is weakening in some emerging markets. In 2018, oil demand growth was 1.3 million barrels per day; thanks to China (0.44 mln bpd), India (0.21 mln bpd), and the United States (0.54 mln bpd).

- The demand growth in OECD countries is expected to decline from 0.39 million barrels per day in 2018 to 0.28 million barrels per day. But the demand growth for non-OECD countries is expected to rise from 0.87 million barrels per day in 2018 to 1.15 million barrels per day in 2019. More than 60 percent of the growth is likely to come from China and India.

Global inventories:

- On the inventory side, IEA report shows that OECD commercial stocks fell by 5.6 million barrels in December, the second decline in six months.

- OECD commercial stocks are currently at 2,858 million barrels. Stocks increased by only 4.6 million barrels in 2018.

- In the third quarter of 2018, stocks increased by 58.1 million barrels (630 kb/d), the largest gain since 2015.

- According to IEA, OECD holdings are higher than the 5-year average.

WTI is currently trading at $54.3 per barrel and Brent at $10 per barrel premium to WTI.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX