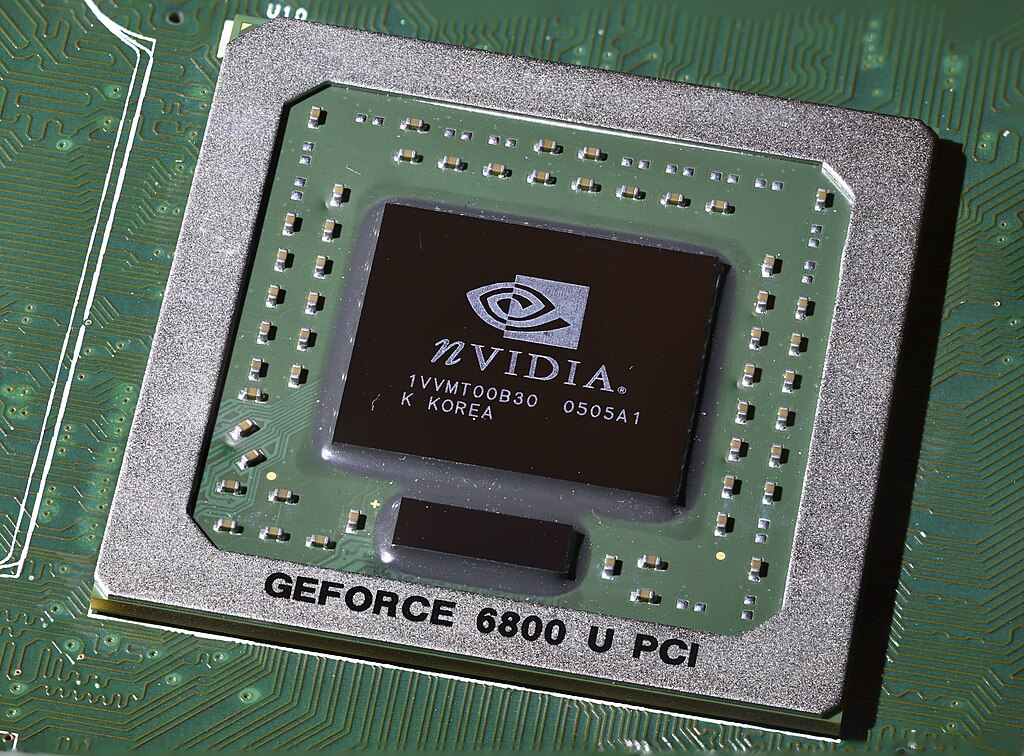

Nvidia (NASDAQ:NVDA) surpassed Wall Street expectations in its fiscal Q1 earnings, even as it flagged an $8 billion hit to its Q2 guidance due to U.S. export restrictions on chip sales to China. Shares rose over 4% in after-hours trading following the announcement.

For the quarter ending April 27, Nvidia reported adjusted earnings per share of $0.96 on revenue of $44.06 billion, topping analyst estimates of $0.93 EPS and $43.31B in revenue. The company’s data center division, which drives most of its revenue, grew 73% year-over-year to $39.1 billion, slightly below the $39.36B consensus. Gaming revenue rose 42% from the prior year.

CEO Jensen Huang emphasized soaring demand for AI infrastructure, noting a tenfold surge in AI token generation in the past year. Huang described AI as “essential infrastructure” akin to electricity or the internet, positioning Nvidia at the core of the global AI transformation.

The company disclosed a $4.5 billion charge from the U.S. ban on sales of its H20 chips to China—less than the expected $5.5B—thanks to reusing some materials. However, Nvidia still forecasts Q2 revenue of $45 billion, plus or minus 2%, falling short of the $45.66B consensus due to the ongoing impact of the export restrictions.

Huang added that enterprise AI adoption is in its infancy and predicted more announcements of AI "factories" globally. Wall Street responded positively to the results, with Wedbush’s Daniel Ives calling it another win for “the Godfather of AI.” Ives noted that Nvidia’s gross margin would have been 71.3% without the China-related charges, reinforcing strong demand despite geopolitical headwinds.

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised