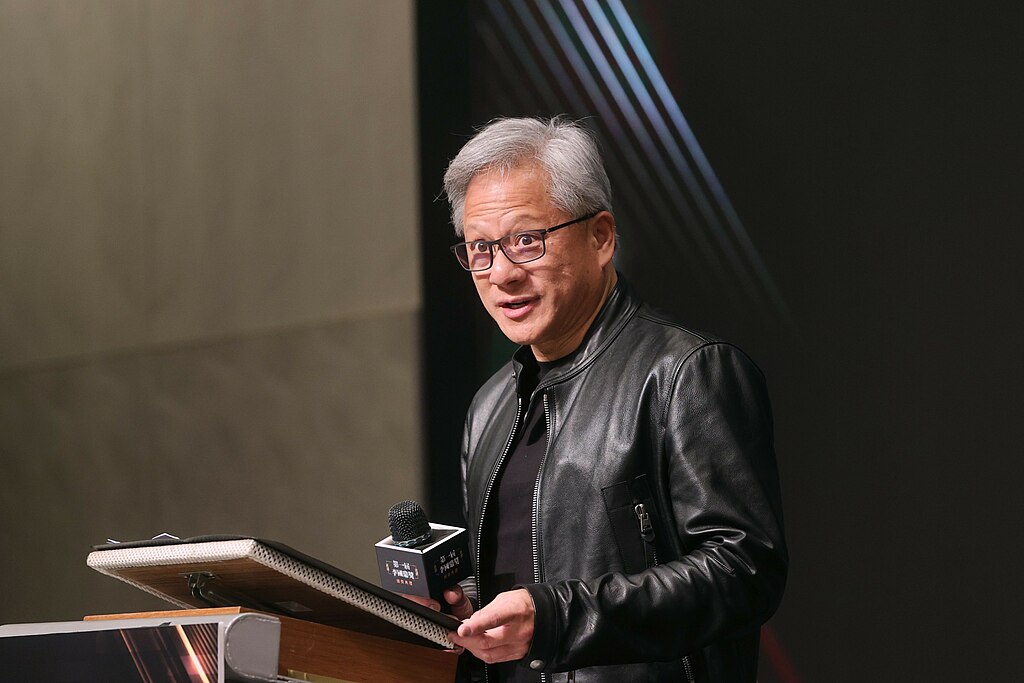

Nvidia (NASDAQ:NVDA) CEO Jensen Huang has initiated the sale of some of his company shares as part of a pre-planned $865 million stock disposal, according to filings with the U.S. Securities and Exchange Commission (SEC) released Monday evening.

Huang sold 100,000 Nvidia shares in two tranches, generating nearly $14.5 million in gross proceeds. This sale is part of a broader plan to offload up to 6 million shares throughout 2024 under a Rule 10b5-1 trading plan. These plans allow corporate insiders to sell stock at predetermined times to avoid insider trading violations and minimize market disruption.

Despite this move, Huang still owns over 900 million shares in Nvidia, maintaining nearly a 4% stake. The proposed sale under the trading plan accounts for less than 1% of his total holdings.

Nvidia shares have surged dramatically over the past two years, fueled by skyrocketing demand for its industry-leading AI chips. The company's GPUs have become central to the global artificial intelligence boom, helping Nvidia climb to the top ranks of the most valuable companies on Wall Street.

Huang has remained bullish on the company’s AI-driven growth, and there are currently no signs that the momentum behind AI hardware sales is slowing. His strategic share sale aligns with personal financial planning, while maintaining confidence in Nvidia’s long-term prospects.

The company’s rapid rise underscores its dominance in the AI chip market, positioning Nvidia as a key player in the ongoing tech transformation driven by artificial intelligence.

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand

Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns