SNB convenes on 17 September to announce the quarterly monetary policy assessment and is widely expected to keep the key policy rates unchanged at -0.75%. Although the international environment has become more uncertain, Switzerland continues to show some positive signals. The outlook for Switzerland's economy has turned broadly positive for the first time in a year, with businesses beginning to absorb the shock of January's effective revaluation of the franc.

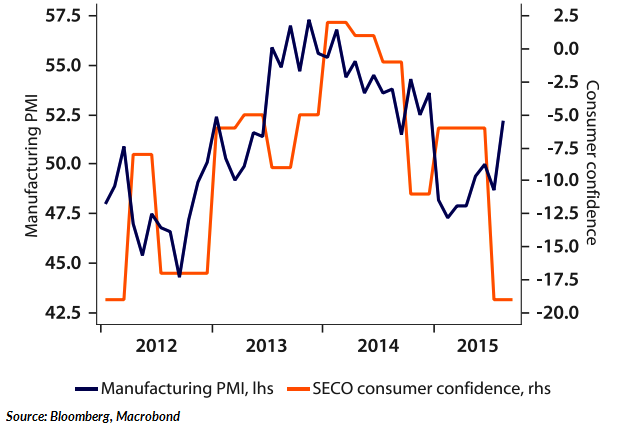

Recent soft economic data have been mixed. Consumer confidence fell sharply to -19 in August, but the purchasing managers index increased and is currently above the 'neutral' 50-mark. The economy avoided a technical recession in Q2, with a much better than expected growth of 0.2% q/q (-0.1% expected) after a contraction in Q1. Data shows that companies in Switzerland's export-dependent economy had shown themselves better able to adjust to the strong franc than expected, while consumption has also proven very stable.

The main worry for the SNB remains inflation, which is expected to have remained in negative territory in August (consensus: -1.4%). President Jordan said that Swiss deflationary pressures have a different origin than those of countries such as Japan. Indeed, Switzerland is still feeling the pain from the sharp currency appreciation in previous years. Sharp fall in oil prices are also seen as the main reason behind these sub-zero inflation readings.

That said, CHF's correlation with volatility indices (for example the VDAX) has become positive, which means that news bouts of volatility result in a weakening of the Swiss franc. The Swiss franc is no longer the first choice as a safe haven for investors and has weakened vis-à-vis its major trading partners. Also the oil price increase of around 20% in recent days can be seen as a positive surprise for inflation.

In a recent interview, SNB president Thomas Jordan said that he sees no reason for a change in policy, but that the SNB stands ready to intervene. This means that the rate on sight deposits will probably not be adjusted downwards and will remain at -0.75%, when the SNB convenes on 17 September.

The central bank will try to calm the markets, if necessary, via verbal intervention. For example, by repeating its comments that the franc is markedly overvalued and that the Swiss National Bank stands ready to intervene if necessary. But, as the Swiss franc is currently weakening vis-à-vis the euro, there is no immediate need for intervention.

"In the absence of significant EUR weakness we think the SNB will accept things as they are given its toolbox constraints. Thus we expect the SNB to keep the key policy rates unchanged at -0.75% in September. Pricing is for a gradual normalisation of SNB rates (and no more cuts) as late as 2017; we see this as largely fair." notes Danske Bank in a research note to its clients.

USD/CHF range bound, plays 0.9735/93 on the day. EUR/CHF cross off 1.0971 highs (1.0983 Tues top), trades at 1.0935 at 1126 GMT

No immediate need for SNB to intervene

Thursday, September 10, 2015 11:40 AM UTC

Editor's Picks

- Market Data

Most Popular

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary