Evidence runs plenty that US economy is rebounding and last year it has really gathered pace but to slow down in the first quarter this year. According to economists and FED officials, recovery is likely to gather pace once more in the second and third quarter of the year. May's superb NFP report supports the theory.

However the recovery is far more uneven when considering the housing market.

At one hand, there are places in US like San Francisco, where even millionaires would reconsider before trying to buy a house and there is Virginia, where negative equity mortgage is still a concern.

- Regulatory issues such as increasing the loan to value ratio or raising local taxes on mortgages might solve the higher price issue it can do little to save the families still suffering from negative equity mortgages and higher interest rates would increase the pain of refinancing.

If FED considers moving ahead with a rate hike this year, it will result in higher interest rate expectation in future, resulting in further tightening in Mortgage rates.

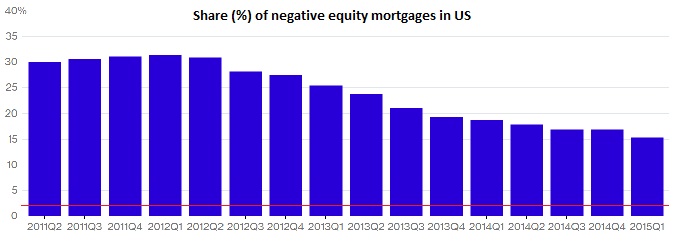

- Higher mortgage rates risk, increasing the housing inventory, which are under water, meaning cost of mortgage loan is higher compare to the house. According to survey by Zillow Inc. share of negative equity mortgages runs pretty high around 15% throughout country. It is lowest in San Jose, San Francisco around 3% but runs as high as 25% in Virginia. Chart courtesy Bloomberg.

Several Fed officials such as Mr. Evans are likely to point this to other FED official and urge to reconsider rate hike in 2016.

Market is awaiting FED's stance to clarify on June 17th press conference.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings