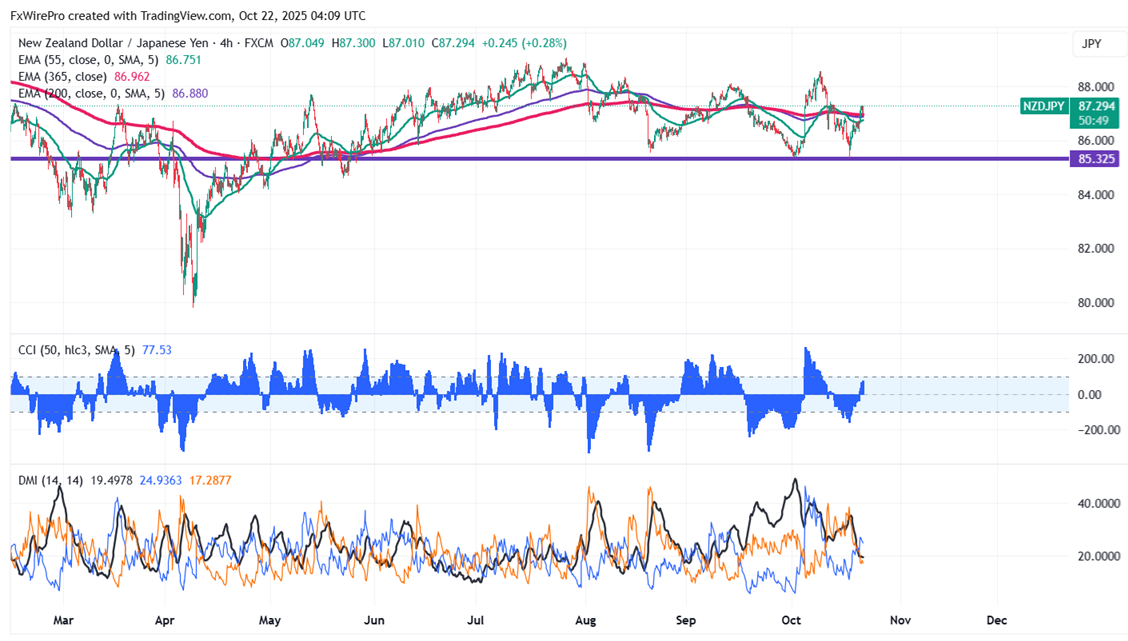

NZDJPY holds above 87 as yen weakness persists. As long as support 86 holds, the intraday trend is bullish. Having hit an intraday high of 87.26, it currently trades at roughly 87.261. The overall trend remains weak if the pair trades below 89.20.

Oscillators and moving averages to forecast the trend of NZDJPY

CMP- 87.26

EMA (4-hour chart)

55-EMA- 86.74

200-EMA- 86.88

365-EMA- 86.97. The pair trades above the short and below long-term moving average.

Major support- 86.70. Any breach below will drag the pair down to 86.40/86/85.37.

Major resistance - 87.50. Any break above 86.86 confirms minor bullishness, a jump to 88.10/88.50/89.25.

Indicator (4-hour chart)

CCI (50)- bullish

Average directional movement Index- Neutral. All indicators confirm a mixed trend.

It is good to buy on dips around 87 with SL around 86.40 for TP of 88.10/89.