NZDJPY pared some of its gains as the yen gained momentum on policy divergence between the Fed and the BOJ. Intraday trend remains bullish as long as support 87.20 holds. It hit an intraday high of 88.01and is currently trading around 87.71. The overall bearish trend is intact as long as the resistance at 89.20 holds.

Technicals-

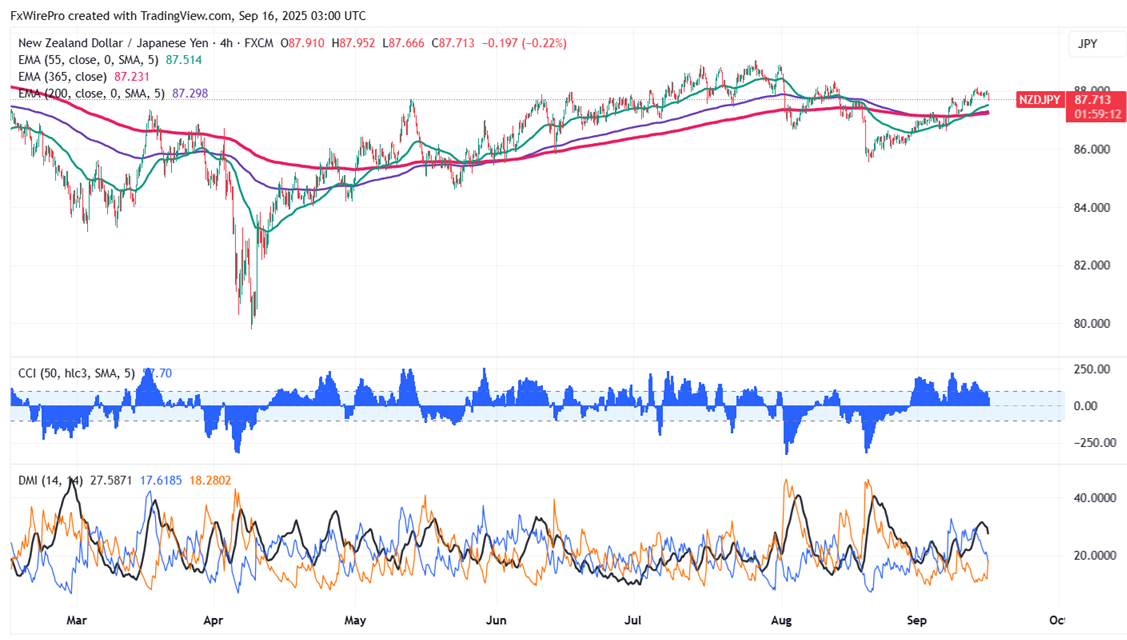

The pair is trading above 55 EMA, 200-EMA, and 365 EMA in the 4-hour chart.

The near-term resistance is around 88.20, breach above targets 89.20/90. The immediate support is at 87.40; any violation below will drag the pair to 87.20/87/86.65/86/85.50/85.10/84.06.

Indicator (4-hour chart)

CCI (50)- Bullish

Average directional movement Index- Neutral. All indicators confirm a mixed trend.

It is good to buy on dips around 87.40 with SL around 87 for TP of 89.20/90.