New Zealand’s unemployment rate ticked down to 4.0 percent in the December 2019 quarter – below ANZ, market, and RBNZ expectations of 4.2 percent. This followed a downwardly-revised print of 4.1 percent in Q3. These data can be volatile on a quarter-on-quarter basis, but the underlying details point to a robust labour market and household sector.

However, the unemployment rate remains within the RBNZ’s estimate of full employment (a range of 4.0-4.4 percent), consistent with underlying inflation pressures holding close to the target mid-point and ‘maximum sustainable employment’.

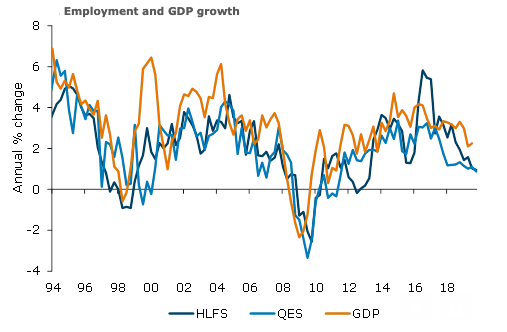

Employment growth in Q4 was weak, with HLFS employment (a survey of households) flat q/q. Annual employment growth was also flat at 1.0 percent, and continues to move within the broad range of indicators. QES employment (from a survey of businesses) was also modest. QES filled jobs rose 0.1 percent q/q, with annual growth slowing from 1.1 percent in Q3 to 0.9 percent.

But offsetting the slowing in employment growth in terms of labour market capacity pressures, growth in the working-age population continues to slow. The participation rate ticked down 0.3 percentage points to 70.1 percent, but remains at a historically high level.

In addition to employment, hours worked can provide an indication of economic activity and slack, though it can be noisy. QES hours paid (which tends to track GDP growth over history) grew 0.6 percent q/q, with annual growth lifting 0.5 percentage points to 1.6 percent.

This is consistent with our current forecast of 0.5 percent q/q (1.7 percent y/y) for Q4 GDP growth. On the other hand, HLFS hours worked (which is far more volatile) posted a 0.5 percent q/q decline, pushing annual growth from 2.3 percent to just 0.5 percent.

Public sector wage growth came in at 0.8 percent q/q, pushing annual growth from 3.0 percent in Q3 to 3.2 percent in Q4. Teacher, nurse, and police pay settlements have bumped up public sector wage growth in previous quarters.

Today’s data will be incorporated into the RBNZ’s February MPS forecasts (out next Wednesday), and are unlikely to have a material impact on their outlook, but they will certainly add to the stronger starting point compared to the November MPS, the report added.

"That said, emerging risks related to the novel coronavirus will be weighing on their thinking and assessment. Developments regarding this tragic shock are fast moving and the impacts highly uncertain. We expect the RBNZ to keep the OCR on hold at 1% next week, acknowledging these risks and emphasising their willingness to provide additional stimulus if required," ANZ Research further commented in the report.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves