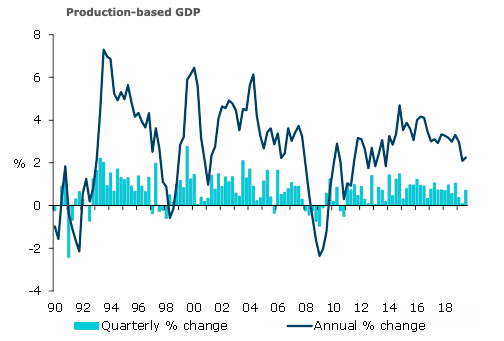

The New Zealand economy expanded 0.7 percent q/q in the three months to September 2019, a touch stronger than the 0.5 percent that was pencilled in. In terms of annual growth, the small positive surprise was offset by downward revisions to Q1 (from 0.6 percent to 0.4 percent) and Q2 growth (from 0.5 percent to 0.1 percent), which together with revisions to 2018 data saw annual growth in line with ANZ’s expectation at 2.3 percent y/y in Q3.

While revisions saw growth hold up a bit better over 2018, the slowdown in growth momentum in 2019 has been sharper.

The RBNZ took the axe to their near-term growth forecasts in the November MPS forecast, and today’s print was stronger than the 0.3 percent q/q they had pencilled in. It was also higher in annual growth terms (they had expected 2.1 percent y/y).

The RBNZ will also take some comfort from the recent lift in forward-looking indicators, which suggests a stabilisation in growth heading into 2020. But it’s still too early to know whether growth will be lifting sharply from there, as per the RBNZ’s November MPS forecasts, the report added.

Agriculture and fishing lifted in the quarter, but a 2.1 percent dip in forestry and a 1.1 percent dip in mining provided some offset. The near-term outlook for forestry and logging is capped as China continues to work through still-elevated inventories.

An increase in services industries (+0.4 percent q/q) was a touch weaker than the 0.6 percent was expected, following Q2’s 0.8 percent q/q lift. The easing trend in annual services growth remains firmly in place, with it slipping from over 4 percent in 2016 to just 2.2 percent in Q3.

There were a few misses in terms of the underlying components, but nothing to challenge the overall narrative. Retail trade was stronger than expected, but wholesale trade was weaker.

"In the meantime, growth continues to fall short of the roughly 2.6 percent y/y rate that the RBNZ needs to see exceeded for inflationary pressure to build. And looking forward, it remains a story of growth just not quite delivering what the RBNZ needs to be confident of hitting its inflation target, with inflation pressures set to wane in this environment and inflation expectations at risk of falling further. Given that, we think that a lower OCR is likely in time. We have pencilled in a 25bp cut in for May, taking the OCR to 0.75 percent," ANZ Research further commented in the report.

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility