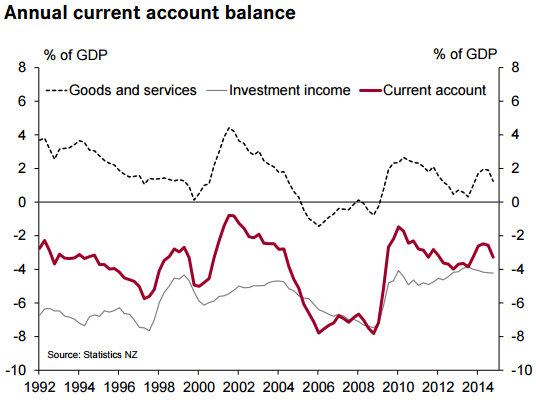

New Zealand's current account deficit widened to 3.3% of GDP in the year to December 2014, in line with market expectations.

The widening of the deficit was largely due to last year's fall in dairy prices, compared to the nearrecord prices received in the previous year.

There were offsetting surprises for us from a jump in spending by overseas visitors, and a rise in the outflow of income earned by foreign-owned companies in New Zealand.

Westpac notes on Wednesdy as follows:

- On an annual basis, the current account deficit is fated to widen further over the course of this year. However, we expect it to narrow again in 2016.

- The deficit is guaranteed to widen further over the course of this year, as the strong dairy export earnings from early 2014 are replaced by the weaker earnings expected for this year. We expect the deficit to reach 5% of GDP by the end of this year.

- We expect the annual balance to improve again from early 2016: dairy export prices have already seen a modest rebound from their lows, while prices for oil imports have fallen sharply and are expected to stay low for some time.

- A deficit of 5% is not pretty by anyone's standards, but as long as it proves to be a temporary peak it shouldn't trouble the credit rating agencies or market perceptions of New Zealand's riskiness.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022