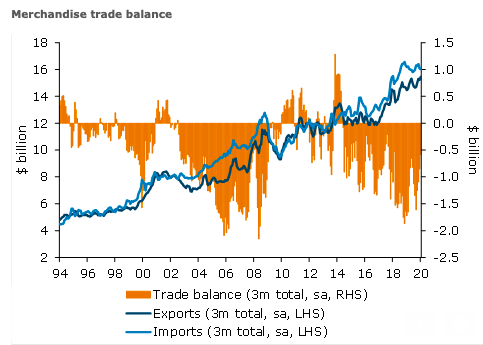

New Zealand’s unadjusted trade balance saw a deficit of $340 million, which was stronger than expected. Exports fell seasonally, but not by as much as expected. The majority of the supply chain disruptions due to COVID-19 didn’t occur until February, ANZ Research reported.

The annual deficit narrowed to $3.87bn. Imports in January weakened only slightly to $5.07bn after December data was revised up to $5.12bn.

Export values came in at $4.7bn (up 8.8% y/y). Meat returns were up 30.5% y/y. On a seasonally adjusted basis meat export volumes lifted 4.5% m/m, dairy was up 0.6% m/m but forestry export volumes were down 15% m/m.

But strength in pricing saw the value of forestry exported lift 18% m/m while meat returns eased slightly. The latter was expected as the prices being offered by Chinese importers eased back just prior to Christmas.

January was a particularly strong month for imports of petroleum products with import values up 20.7% m/m. That said, petrol was down 1.6% y/y and back 9.7% y/y in the 3mths to January primarily due to lower oil prices. Imports of textile products lifted sharply having gained 27.5% m/m on a seasonally adjusted basis.

Pharmaceutical imports were back 12% y/y in January and are down 1.4% in the past year. Supply disruptions for goods imported from China are expected to impact this category in February which is concerning.

"Going forward, we expect a major reduction in both exports and imports in February and March due to the slowing of supply chains in and out of China. Exports will also be impacted by the drought in NZ which is starting to decrease milk output but increase the immediate supply of meat for export. However, the impact of the drought on trade data will be dwarfed by the restrictions on shipping that is occurring due to port congestion and lack of availability of refrigerated containers," ANZ Research further commented in the report.

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock