NVIDIA (NASDAQ: NVDA) shares surged 2.5% on Thursday, reaching a new 52-week high after Cantor Fitzgerald analyst C.J. Muse raised his price target to a Street-high $300 per share. The revised target implies a potential $7.3 trillion market valuation—up from the chipmaker’s current $4.7 trillion, already making it the world’s most valuable company.

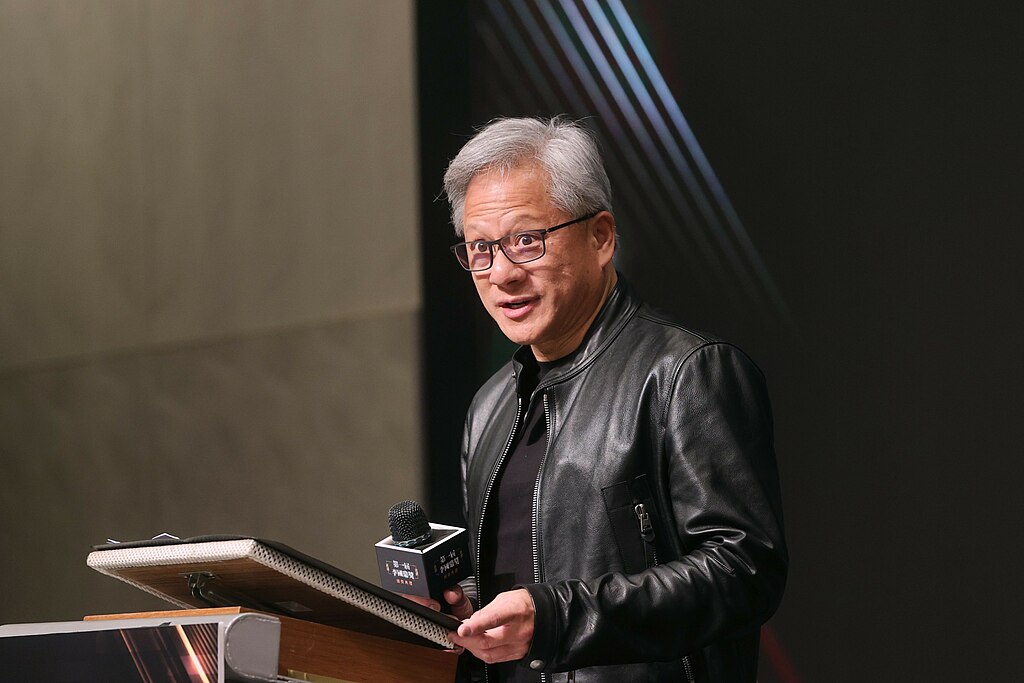

Muse’s upgrade follows investor meetings in New York with NVIDIA CEO Jensen Huang, CFO Colette Kress, and other top executives. Dismissing talk of an AI “bubble,” Muse emphasized that we’re still in the “early innings” of a multi-trillion-dollar AI infrastructure buildout. He noted that major hyperscalers are fueling hundreds of billions in demand, while emerging drivers like Neo-Clouds, enterprise AI, and physical AI continue to expand the market opportunity.

A standout takeaway from the meetings was NVIDIA’s deepening partnership with OpenAI. The collaboration aims to transform OpenAI into a self-hosted hyperscaler—cutting out server manufacturers and cloud providers to reduce costs and margin stacking. This move could pressure the ASIC market while enhancing NVIDIA’s competitive edge. Muse added that NVIDIA’s annual “Extreme Co-Design” cycle further strengthens its full-stack AI ecosystem, powered by CUDA-X, enabling large-scale, end-to-end deployment.

Muse forecasts NVIDIA’s earnings power to reach $8 per share in 2026—well above the current consensus of $6.26—and potentially $11 in 2027 versus the $7.36 consensus. Based on a 27x multiple of the 2026 estimate, his $300 target suggests over 60% upside. He projects even greater long-term potential as NVIDIA targets $50 in EPS by 2030 amid a $3–4 trillion AI infrastructure landscape.

In Muse’s words, channeling Bruce Springsteen: “NVDA was (and continues to be) Born to Run.”

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit