US/UK policy divergence relative to the rest of the developed world is becoming more and more evident. The US looks set to normalize policy rates as early as September and the Bank of England by Q1 2016, leading the DM pack. At the other end of the developed market spectrum are the QE central banks - the ECB and BOJ.

Incoming data have been supportive. FOMC communiqué was modestly upbeat and U.S. Q2 GDP report healthy, which also included significant upward revisions to Q1 growth. The UK economy is also on a strong footing, with Q2 GDP growth accelerating to 0.7% q/q (Q1: 0.4%), powered by resurgent services and confidence.

In Japan Q2 GDP is likely to post a 1.7% annualised contraction (earlier: -0.5%). Bank of Japan (BoJ) will hold its monetary policy meeting on Friday and it is widely expected to keep monetary policy unchanged.

"Although we believe recovery will resume in H2, we expect the BOJ to hike no earlier than 2018 and not before further easing in April 2016 via an expansion of an equity-linked ETF purchases", said Barcalys in a research note to its clients.

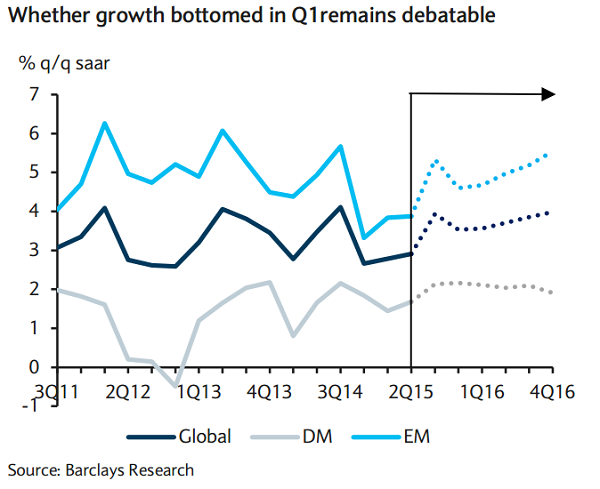

Not just DM - growth and policy divergence within EM is also widening. An easing bias is evident in Asia, while EMEA and Latin America are seen on a neutral or tightening bias.

Q2 trough in Asia was deeper than expected. Q2 GDP outturns in industrialised Asia have been especially dismal - Singapore (-1.2%), Taiwan (-2%) and Korea (0.3%) - largely on high inventories in the electronics supply chain. Even in India, where growth is improving, it is believed the softer inflation backdrop is raising the probability of a 25bp repo rate cut by the RBI later in H2 15. Although China reported stronger Q2 GDP (+7%), it is keeping the easing bias to temper a sharp equities correction.

On the other (tightening) end of the EM spectrum, Latin American central banks remain on a tighter bias to fight inflation and in response to the stronger transmission from higher US rates. In Brazil, the Copom hiked the Selic rate by a further 50bp this week to 14.25% (16th rate hike since 2013) as it tries to anchor inflation amid political pressure - even as growth slows.

"We do not expect a further hike in Brazil, but we do expect Banxico to react to a potential Fed move by hiking on 21 September", added Barclays.

Monetary Policy divergences start to widen across developed markets and EM

Monday, August 3, 2015 10:01 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?