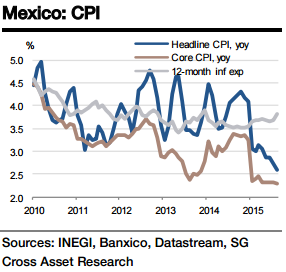

Mexico's inflation slipped below 3.0% (the Banxico's target) in May for the first time in a decade and has declined even further since then, as core inflation remained at its lowest level ever at 2.3% and food inflation fell to its lowest levels in 16 months. The key component of core inflation - dwellings - remains the single most important factor keeping inflation below target.

It is difficult to factor in a significant rise in core prices in the next few months given the low wage pressure and the substantial output gap while MXN passthrough remains low. The bi-weekly series for mid-September is likely to report annual inflation at 2.48% yoy, estimates Societe Generale.

Mexico's inflation rate is expected to revert to its medium-term trend in 2016 when the base effect of lower telecom and energy prices ebb. Broadly, the inflation situation remains conducive to Banxico's current accommodative stance, and economic growth and the Fed's policy stance are likely to be the key factors in monetary policy decisions in the near term. The country's inflation rate is likely at 2.9% in 2015 and 3.5% in 2016, says Societe Generale in a research note to its client.

Mexico's inflation likely to slip again in September

Thursday, September 24, 2015 6:29 AM UTC

Editor's Picks

- Market Data

Most Popular

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target