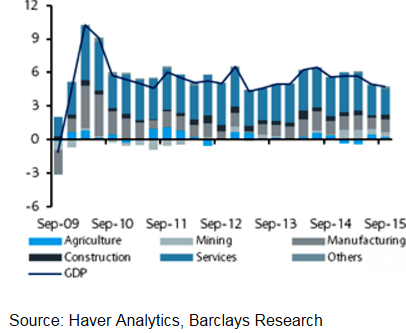

Malaysia's Q3 GDP rose 4.7% year on year, as per the consensus expectations, with domestic growth remaining robust despite weaker business and consumer confidence.

"With YTD GDP growth coming in at 5.1%, 2015 growth is forecasted at 5.0%, but have lowered our 2016 growth projection to 4.7% from 5.3%. We expect Bank Negara Malaysia (BNM) to leave rates on hold through 2016, as growth slows at the margin and underlying inflation remains in check", says Barclays in a research note.

MYR has been under pressure in recent months, BNM is unlikely to undertake an interest rate defence of the MYR. On a seasonally adjusted basis, Q3 growth slowed modestly to 2.6% q/q saar, from 4.5% in Q2 15.

Strong manufacturing performances, construction and mining supported the rise in growth, by mitigating soem post-GST weakness in services. Especially, strong non-oil exporters, robust demand and a post-GST rebound in consumer durables.

"The growth should be partially offset by a gradual improvement in the country's net exports, underlying domestic activity is likely to soften. A slowing growth backdrop in Asian economies, particularly China, will also weigh on the external sector", states Barclays.

The private consumption is likely to moderate at the margin, as wage growth slows and the fiscal position remains a drag on the economy.

Malaysia's consumption continues to slowdown modestly

Friday, November 13, 2015 4:57 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed