Chinese electronics manufacturer Luxshare Precision Industry (SZ:002475) surged to record highs this week after reports revealed a partnership with OpenAI to develop a consumer artificial intelligence device. Shares jumped 10% on Monday and Tuesday, outperforming the broader market as the Shanghai Composite Index fell 1%. The stock touched an all-time high of 67.05 yuan.

The Information reported that OpenAI struck a deal with Luxshare to produce AI hardware designed to integrate closely with ChatGPT and other OpenAI models. The news comes only months after OpenAI acquired hardware startup io Products, founded by former Apple (NASDAQ:AAPL) design chief Jony Ive, signaling the company’s ambitions in AI-driven consumer electronics.

Luxshare, a leading assembler of iPhones and AirPods, is considered well-positioned to bring AI hardware to market given its expertise in advanced consumer devices. Meanwhile, Goertek (SZ:002241), another Apple supplier, was also approached by OpenAI to provide audio components. Goertek manufactures AirPods, HomePods, and Apple Watches.

Investor sentiment around Goertek was mixed. Its shares fell 5.5% on Tuesday after rallying 7.7% the previous session. Still, analysts at CLSA reiterated an Outperform rating, supporting optimism about the company’s role in the AI hardware supply chain.

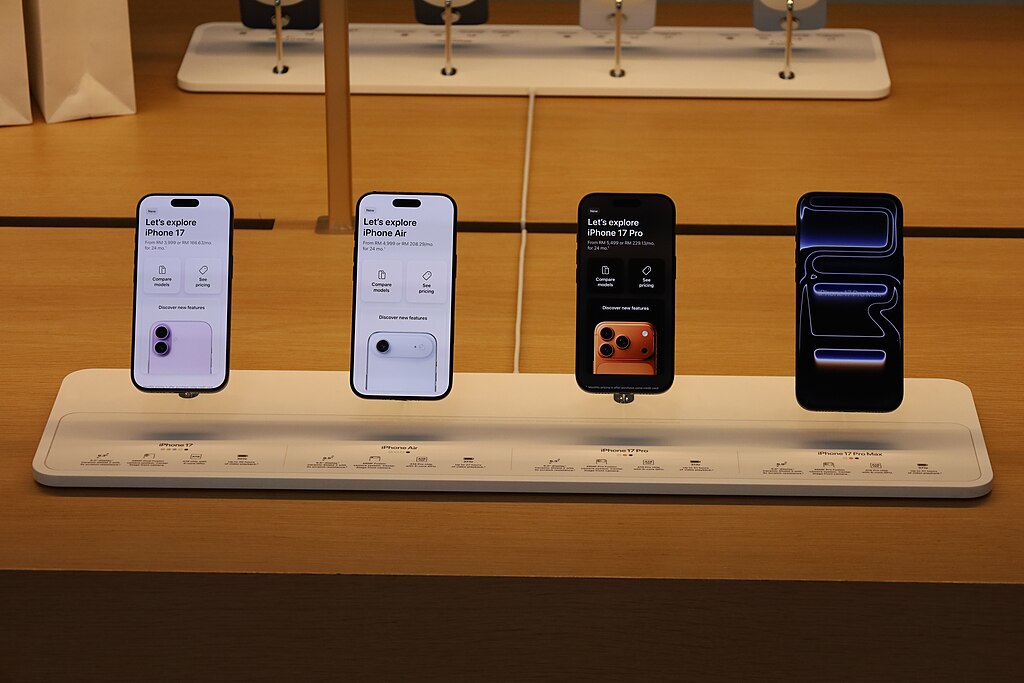

Apple suppliers more broadly also saw a boost, with expectations of strong demand for the newly launched iPhone 17 adding momentum.

The potential collaboration between OpenAI, Luxshare, and Goertek underscores the growing intersection between artificial intelligence and consumer electronics, highlighting China’s critical role in Apple’s supply chain and the next generation of AI-powered devices.

Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate