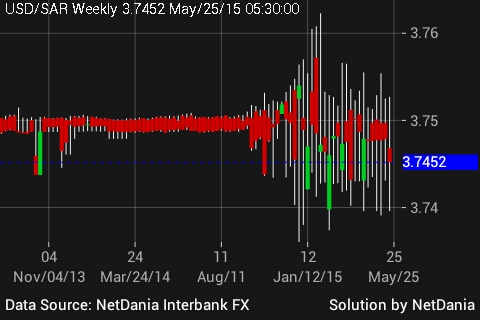

Saudi Arabian Riyal has been pegged to US Dollar since 2003, officially at 3.75. This year the peg is experiencing pressure and volatility as dwindling oil revenue puts pressure on Saudi coffer.

It was during 2008/09 crisis that Saudi Arabia faced similar pressure on its peg. In September 18, 2007 Saudi Currency reached 20 year high against dollar, however was pegged back in December.

This time around the pressure is on upside. Riyal should depreciate given lower oil price and stronger dollar.

Saudi official likes to argue that the peg has worked wonderfully for them, this time around that is not the story. Most of the oil producing economy like Canada, Mexico was able to cushion the crude shock as their currency depreciated against dollar, thus balancing the revenue earned in local currency.

Saudi economy had to absorb the shock of lower oil price completely since Riyal is pegged to Dollar.

Are there any risk to the peg?

- As of now, there are little risk to the peg since Saudi Arabia still has about $698 billion of reserves, which is sufficient to defend the peg if required.

Future risk -

- Saudi Arabia's Reserve is down from $740 billion in January to $698 billion by April. If oil price maintain at current level or lower for long and dollar keep appreciating, there could be real threat to the peg. Saudi forex reserves over the next few months will tell how strong the pressure is.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary