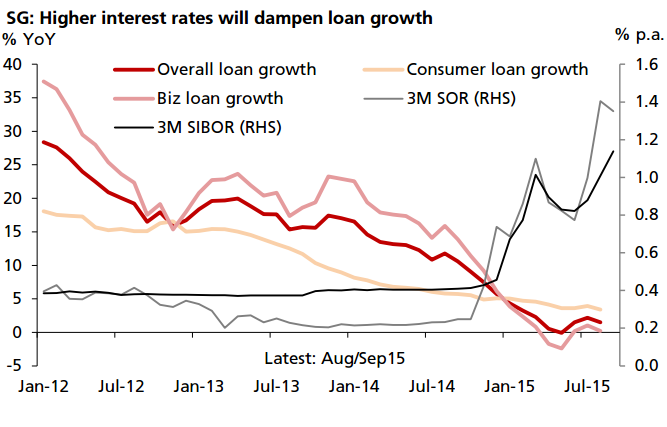

Loan growth has moderated again in Singapore. After a modest uptick to 2.2% YoY in the previous month, overall loan growth slipped to 1.5% in August. This is mainly driven by a sharp drop in business loan growth to 0.2%, from 1.1% in July. Separately, consumer loan growth also moderated by 0.5%-pt to 3.4%, led mainly by an easing in housing loans. This is in line with the earlier view that there is significant downside risk to loan growth given the slowdown in economic activities and upside risk in interest rates.

The economy has contracted by 4.0% QoQ saar and risk of another quarter of contraction has risen significantly over the past 2 months. In addition, business loans in particular are linked to the Swap Offer Rate (SOR). And unlike the interbank rate (SIBOR), SOR tends to be more volatile as it is also linked to currency movements. Depreciation in the SGD, following the weaknesses in Asian currencies, has already led to the spike-up in SOR. With an overarching Fed hike expectation, risk is for interest rates to rise further. Higher interest rates will continue to take the toll on loan growth in the coming months.

Loan growth has moderated again in Singapore

Thursday, October 1, 2015 1:57 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed