Overcapacity, declining investment returns and high debt levels remain an ongoing issue for Emerging Market FX going forward. When Western economies were growing fast, EM overcapacity was not an issue. The problem is that Western economies' growth potential has declined. For AxJ economies to improve, better global demand for their manufacturing sector output is required.

A lack of investment spending is pushing DM productivity levels lower. Ironically, weak capex has allowed DM corporates to run profitability-boosting cash flows by depreciating capital stocks at a faster pace than replacing outgoing capacity. The result is that DM economies are left with low growth potential, which will not help them to utilize EM's overcapacity.

Overcapacity and debt-laden economies have two problems to deal with. Either weak DM demand fails to utilize capacity, or tighter monetary policy and its impact on global funding costs affect the EM performance. Often investors look for guidance by exploring previous occasions when the Fed started increasing rates. Generally, the USD has rallied into the event, but gives up some of its gains thereafter.

"We expect the Fed to act in a very transparent way when starting to hike rates. Within its related interest rate statement the Fed may promise gradualism when normalizing rates and (all things equal) the USD should correct lower with the help of what we call a 'lazy rate hike'", says Morgan Stanley in a research note to its clients.

When the Fed started hiking rates in 2004, promising predictable 25bps steps going forward, for more than half a year into the rate hike cycle the USD remained investors' funding currency of choice. High yielding FX rallied and even when the USD started to gain against low yielding currencies, such as the JPY, CHF and EUR, the EM asset class continued to rally. However, there are significant differences between 2004 and now, suggesting higher US rates will have a more powerful impact than in 2004.

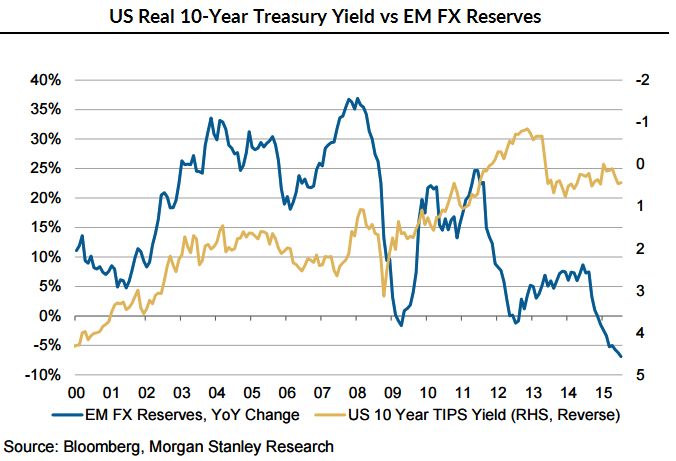

Global reserve holdings have declined rapidly as once strong EM inflows have reversed into outflows. Falling reserves suggest the pool of funds invested into core sovereign bond markets has declined, which should push yields higher too. These structural forces have the potential to push real yields in core countries higher, not boding well for hard currency funded creditors. Against this background corrective EM FX potential coming on the back of the Fed delaying hikes should be limited.

When risk normalizes with a time delay, leading to rising US rate expectations, then EM/commodity FX will develop vulnerabilities via the prospect of rising USD funding costs. With rising volatility, EM would suffer due to repatriation, in particular hitting 'double-deficit' currencies such as the TRY, ZAR, BRL and IDR.

Limited relief for EM FX

Tuesday, September 1, 2015 11:44 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary