We see a high probability of Bank of Canada cutting rates next Wed to support Canada's flagging economy. Canadian economy is tracking well below the 1.9% pace expected by the Bank of Canada in its April 2015 MPR. In the absence of another interest rate cut, this means it could take a year longer than the Bank of Canada expected for the Canadian economy to return to its trend level of output.

The widened Canada's trade deficit also fuels expectations the Bank of Canada could cut interest rates as early as next week to support an economy at risk of recession. The shortfall totaled C$3.34 billion ($2.63 billion), Statistics Canada said on Tuesday. The Canadian dollar hit a 3-month low while traders increased bets that the central bank will cut rates to 0.5 percent on July 15, pricing a 51 percent likelihood.

While the worst of the economic hit from the oil price collapse is likely now behind us, there was little in BOS report to inspire optimism about Canada's economy. Business investment intentions continue to be a weak spot. Statistics Canada's survey on investment intentions released earlier this morning, pointed to a 7% contraction in private sector spending in 2015.

"Looking further ahead, the yawning output gap in Canada due to the weak economic performance in 2015 has also push back our expectations for any future hiking cycle. We now expect the Bank of Canada to stay its hand on this front until mid-2017", Says TD Economics in a note to its clients.

CPI inflation, particularly the core measure that the Bank of Canada uses as its operational target for monetary policy, also remains around target and does not reflect the features of an economy in recession. To mitigate this impact, it is likely that the Bank will use the only means it has at its disposal - another interest rate cut.

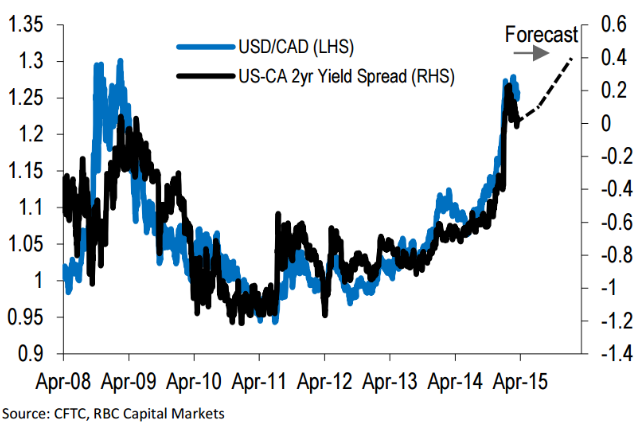

"We believe the key drivers of USD/CAD strength should come to a head in the second half of 2015 and we continue to call for a Q3 peak of 1.31. The BoC has taken on a firmly neutral message, and our economists expect the BoC to keep rates at 0.75% until Q2 2016. Regardless of the exact timing of an eventual rate increase though, the issue is that the BoC hiking cycle will considerably lag that of the Fed, which is likely to begin in the second half of this year." says RBC Capital Markets

On account of monetary policy divergence between the Fed and Boc, Canadian 2-year bond yields are likely to edge lower by 10 to 15 basis points, causing the spread to their U.S. counterparts to widen.