CFTC commitment of traders report was released on Friday (12th July) and cover positions up to Tuesday (9th July). The COT report is not a complete presenter of entire market positions; however, it represents a good chunk of institutional traders, to feel what’s going on in capital markets and how big traders are aligned.

Kindly note, in some cases, numbers are rounded to the nearest decimal.

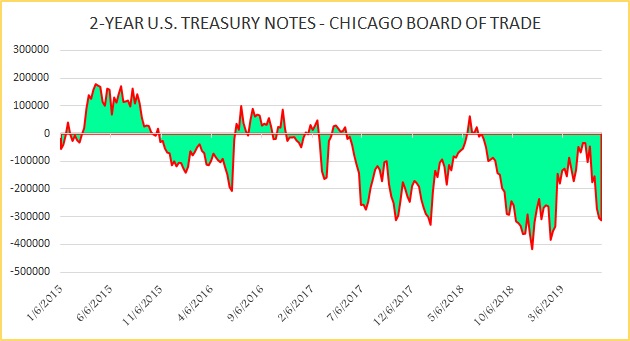

- 2 year U.S. Treasury:

Speculators increased short positions for the 11th time in 21 weeks. Short positions rose by 7,886 contracts that led to a net position of -312.9K contracts.

- 5 year U.S. Treasury:

5 year treasury short positions rose last week and by 7,111 contracts that brought the net position to -94K contracts.

- 10 year U.S. Treasury:

Speculators reduced short positions marginally for the week, and by 48 contracts to -288.8K contracts.

- S&P 500 (E-mini) –

Speculators reduced long positions last week and by 35,882 contracts to +17.2K contracts.

- MSCI Emerging Markets Mini-Index –

Long positions rose in the week ending July 9th and by 14,039 contracts that pushed the net position to +186K contracts.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed