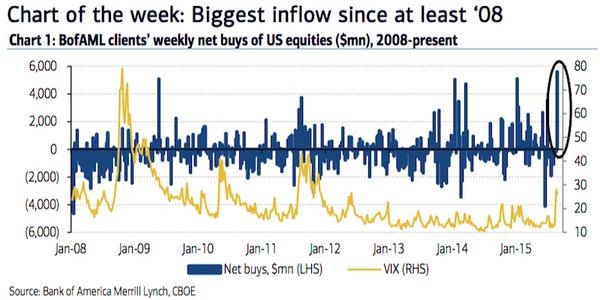

Latest data from Bank of America Merrill (BoFAML) Lynch shows that investors just jumped into equities after Monday resulting in biggest weekly inflow since 2008. According to the bank's client database, investors just poured into stocks in tune of $6 billion.

Last week on Monday, at one point S&P 500 future was down close to 7%, while Down Jones opened 1000 points down at opening bell, from where sharp buying resumed and the week that was thought to be would be worst, ended with equities closing in green.

However, all those money poured might face tough times this week as rout renewed, as concerns over further economic slowdown from China renewed with the country's composite PMI hitting lowest level in more than 3 years.

As retail customers tend to lose money staying on the opposite side of the trend and massive inflow usually precedes a reversal, this flow can be considered as a contrarian signal and it is advised to keep close watch, how S&P500 performs in this week, filled with high risk events and data such as European Central Bank's (ECB) monetary policy and NFP report.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate