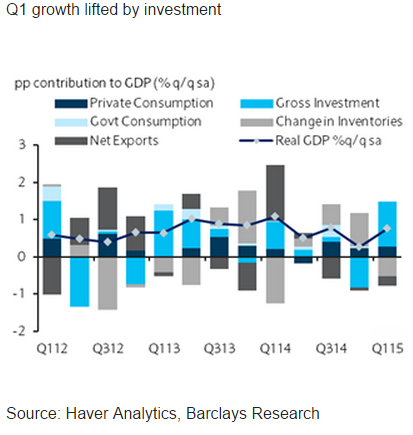

The advance estimate of Q1 GDP showed expansion of 0.8% q/q sa (Q4: 0.3%; Q3: 0.8%), above consensus forecast for growth of 0.6%.

On an annualized basis, growth accelerated to 3.1% q/q saar (Q4: 1.1%; Q3: 3.2%), while on a y/y basis growth slowed moderately to 2.4% y/y (Q4: 2.7%; Q3: 3.3%) - the slowest since Q1 2013.

Growth in Q1 was led by a strong pickup in construction investment, in particular in residential building investment, reflecting the ongoing property market recovery.

Private consumption also improved, growing at 0.8% q/q sa (Q4: 0.3%) on the back of increased spending on durables and services. Net exports remained a drag as the weakness in LCDs and automobiles weighed on exports.

"Although the BoK recently lowered its 2015 growth forecast to 3.1% from 3.4%, we are turning more optimistic on Q2 as leading indicators continue to suggest an inflexion point for activity", says Barclays.

The global semiconductor equipment book-to-bill ratio, which tends to lead Korea's activity indicators by three to four months, jumped to a nine-month high of 1.10x in March (Feb: 1.03; January: 1.04; December: 0.99), suggesting that Asia's electronics manufacturers are investing in plant and machinery again, an indicator of increased activity from Q2.

Korea Q1 growth lifted by construction

Thursday, April 23, 2015 2:38 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022