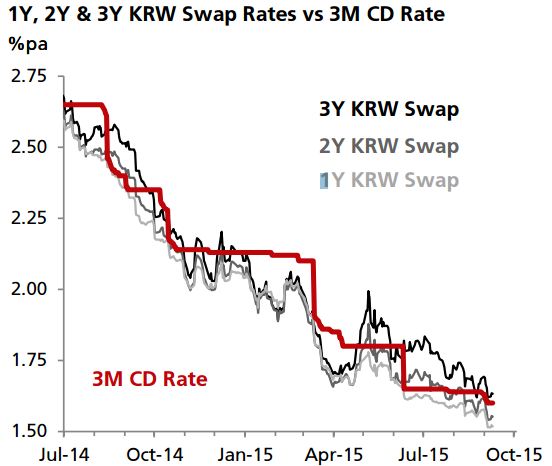

The market is pricing an outside chance of rate cuts within the next six months as sentiment on the Korean economy sours. The market is more dovish for the Bank of Korea (BoK) to keep the policy rate unchanged at 1.5% through to 3Q16.

Over the past two month, short-term KRW swaps (2Y and 3Y) have completely retraced the upmove seen in 2Q this year and are plumbing new lows. The renewed collapse in commodity prices and lackluster export demand are the two key reasons this development.

Speculation of rate cuts to prevent the KRW from being too strong versus peers was a key reason driving KRW swap rates lower. However, according to DBS Bank, this argument is no longer valid as the KRW has weakened significantly over the past few weeks, catching up with its Asian peers. Export competitiveness has become less of an issue. Moreover, with the domestic economy showing tentative signs of bottoming out, the market is likely to focus on domestic and external stability risks.

"In the absence of rate cuts, we think short-term KRW swap rates are biased modestly higher over the coming months," added DBS Bank.

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022