The FOMC minutes of the June meeting provide little insight as the meeting took place before the EU referendum. Most participants noted that the upcoming British referendum on membership in the European Union could generate financial market turbulence that could adversely domestic economic performance. In addition to worries about Britain and the EU, some officials expressed concerns about uncertainties surrounding China's future moves in managing its currency and the impact of relatively high levels of debt on the Chinese economy.

FOMC meeting minutes also underscored questions about prolonged softness in business investment spending. Fed officials attributed much of the weakness to the big plunge in oil prices, which had triggered cutbacks at energy companies. “Some” on the Fed policy committee thought that labour market conditions and inflation were close to the Fed’s goals. But a couple of members said they would need “sufficient evidence to increase their confidence that economic growth was strong enough to withstand a possible downward shock to demand and that inflation was moving closer to 2% on a sustained basis.”

“The July FOMC meeting is certainly off the table. September is in play I suppose, but only if everything breaks perfectly. November is out of the question, in my view, given that it falls less than a week before the presidential election. That leaves December, which is currently my expectation for the next Fed move,” said Stephen Stanley, chief economist at Amherst Pierpont Securities, summing up the thoughts of many Fed watchers.

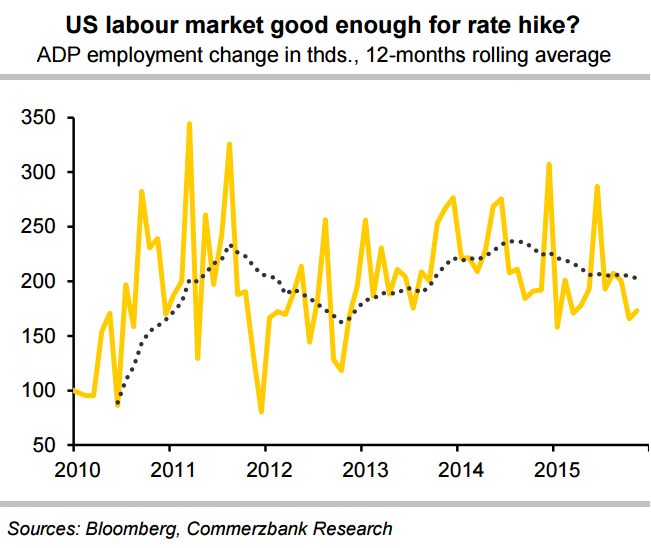

As economic data improves, which has already begun to materialize with growth in GDP in Q2 expected around 3 percent q/q annual rate, the Fed should become confident enough to raise rates sometimes in the second half of 2016. US ISM non-manufacturing index rose 3.3p to 56.5 in June, beating consensus at 53.3. The data was another strong US indicator, pointing towards a pick-up in growth in Q2. However, the trade deficit widened more than expected by $3.8bn to $41.1bn in May and still a drag on GDP growth.

However, financial market turmoil post-UK vote in favour of Brexit and the uncertainty around European banks, indicate that the next rate hike will come later rather than sooner. The Fed's next meeting is scheduled for 27th July. If Friday's US labour market report disappoints once again that would likely be the end of rate hikes this year. Many analysts think even a good jobs report won't be enough to convince policymakers to raise rates, especially in light of the uncertainty triggered by the Brexit vote. Some analysts think the Fed could hold off raising rates until September or possibly even wait until its last meeting of the year in December.

"We expect the Fed to hike rates by 25bp in December and an additional 25bp in June next year," said DNB Bank in a report.

US dollar index subdued on the day, trades around 96.06 levels at 11 GMT. USD/JPY was at 101.11, while EUR/USD at 1.1078.

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices