Japan's Ministry of Finance will announce trade data at 2350 GMT on Oct 20th, and analysts expect Japan's trade deficit to improve modestly in September. According to a Reuters survey, September exports are seen increasing 3.4 percent from a year earlier, after a 3.1 percent increase in August, while imports are likely to fall 11.7 percent, down for a ninth straight month and reflecting falls in energy prices.

Japan's export recovery is likely to remain weak, weighed down by modest US economic recovery and uncertainty surrounding the Chinese economy. The total trade amount seems to be growing, but this is only because most settlements are done in USD and a depreciating Yen pushes up the settlement amount.

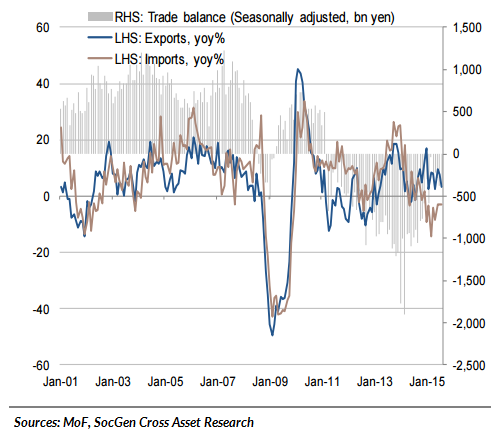

"The Japan's trade deficit is likely to come in at ¥200bn in September 2015, which marks an improvement on the ¥962bn of September 2014. On a seasonally-adjusted basis, the trade deficit should reach ¥302bn in September, slightly better than the ¥359bn seen in August", notes Societe Generale in a research note.

The trade data due on Wednesday could provide a strong clue to whether Japan's economy will avoid recession after it shrank in the April-June quarter. BoJ Governor Haruhiko Kuroda said earlier this month in a press interview following the 7 October meeting that the slowdown in emerging economies was hurting Japan's exports, though he stressed that there was no change to his view the economy was set to continue a moderate recovery.

BoJ's latest Tankan survey confirmed that the business sentiment outlook is deteriorating. Oil prices are no longer falling and the recovery in domestic demand is likely to support import growth. There is an imminent risk that the Japanese economy will enter an economic downturn if the export recovery is delayed to a large extent. Against this backdrop, it will take some time for Japan's trade surplus to reach a sustainable level. However, Japan's trade balance is likely to continue to show improvement in the long term.

"With oil prices having fallen rapidly, terms of Japan's trade are improving, leading to a shrinking trade deficit. Exports in September are expected to have grown by 3.8% yoy (3.1% yoy in August), while imports likely shrunk by 7.1% yoy (vs -3.1% yoy in August)", estimates Societe Generale in a research report.

USD/JPY hit session highs at 119.78 earlier on the day and is currently trading at 119.62 at around 1040 GMT. The pair is seen consolidating above the hourly 200-SMA and awaits fresh cues from the upcoming US data and key trade balance figures. Key price breaks are on the horizon, technicals are supportive for an attempt higher.

Japan to take time to achieve sustainable trade surplus

Tuesday, October 20, 2015 11:13 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate