Neither deflation nor inequality has hindered the bull market on Wall Street in recent years. On the contrary, QE policies to end deflation & spark employment have been very beneficial to asset prices. But now:

The perception of unfair globalization, gilded elites & inauthentic politicians is leading to a rise in both populist politicians (Trump, Sanders, Corbyn) and parties(SNP, Syriza, Podemos, National Front) and... calls for the Fed to raise rates to boost the elderly's return from saving are becoming louder... and the fragile improvement on Main Street is threatened by a stalled global economy in 2015.

"If the secular reality of deflation & inequality is intensified by recession & rising unemployment, investors should expect a massive policy shift in 2016. Seven years after the west went "all-in" on QE & ZIRP, the US/Japan/Europe would shift toward fiscal stimulus via government spending on infrastructure or more aggressive income redistribution", says Bank of America.

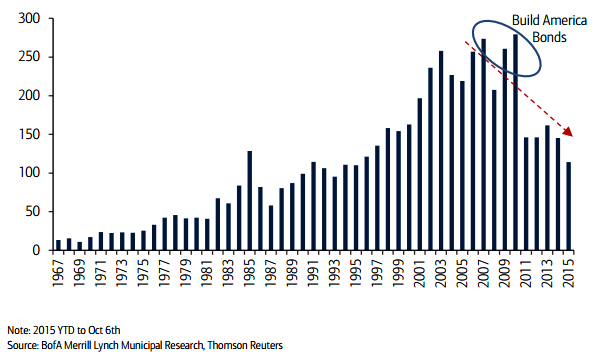

And seven years after China went "all-in" on fiscal stimulus, a shift toward QE/rates/FX to support activity would be likely in the east. The combination of very low bond yields & very low commodity prices means it's the perfect time to finance infrastructure spending. And municipal bond issuance for capital spending on transportation, infrastructure and state spending is actually running in 2015 at its lowest level since 1997.

Investors must discount a new Global Policy Mix in 2016…

Tuesday, October 13, 2015 4:55 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX