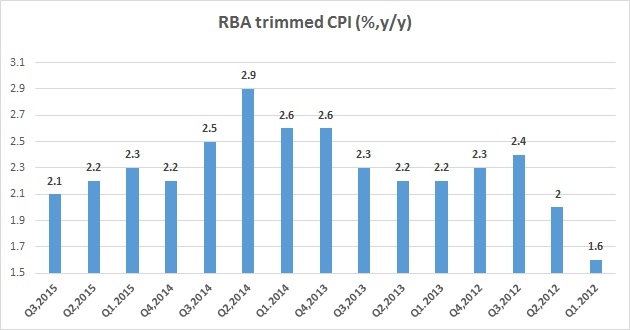

Market participants and economists were taken by surprise as Reserve Bank of Australia's (RBA) preferred measure of inflation dipped to three year low in third quarter.

- CPI rose by 0.5% in third quarter compared to 0.7% in the second and up 1.5% for 12 months to September.

- However, Reserve Bank of Australia's preferred measure trimmed inflation rose only by 0.3% in third quarter, which is weakest since third quarter last year. Yearly CPI came at 2.1%, against median expectation of 2.4%, which is lowest since second quarter of 2012.

Breakdown of key components -

- Most significant price rises were observed in Fruit (+8.2%), Travel and accommodation (4.6%), Property rates and charges (+4.6%).

- Biggest contributors to the drop were Vegetables (-5.9%), Telecommunication equipment and services (-2%) and Automotive fuel (-1.7%).

Australian Dollar has taken a sharp hit as the drop was significant and moreover unexpected. Australian Dollar is currently trading at 0.712 down close to 80 pips from today's high.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand