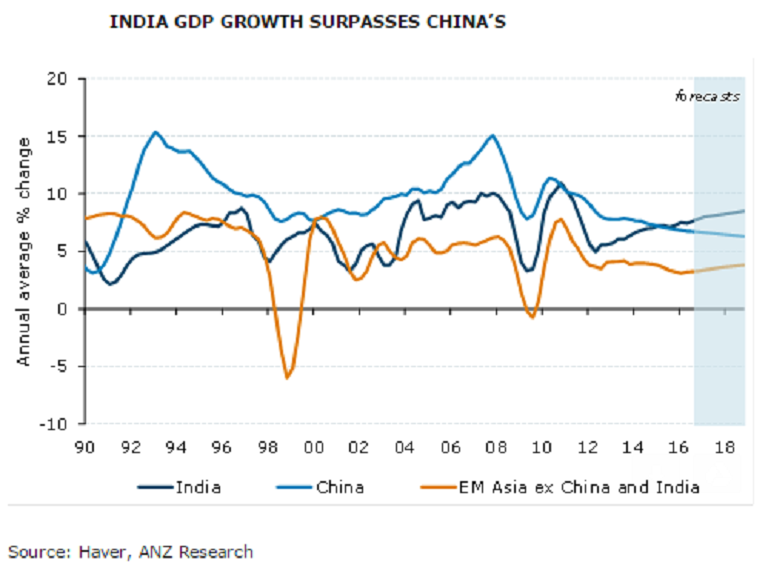

The Indian economy has been growing at a premium to other emerging Asian economies during the recent years, largely owing to a mix of structural as well as cyclical tailwinds. This has resulted in the economy remaining more and more resilient to the ongoing global headwinds, concerning a wide range of economic as well as political events.

An environment of robust domestic macroeconomic fundamentals amid reduced external vulnerability, the center stage is prepared for the country to grow at a forecasted rate of 8.0 percent during the fiscal year 2017 and 8.2 percent during FY2018; easily, reckoning the fastest growing economy in Asia, ANZ reported.

From a structural point of view, India continues to be the torchbearer in the field of 'ease of doing business', establishing a significant ranking in global competitiveness. However, the vulnerable banking sector has remained a major hurdle to an otherwise strong economy, contributing to the weak private investment climate.

Given a better external position, commitment to keep inflation in check, and strong growth prospects, the Indian rupee is expected to be less vulnerable to external shocks. However, the INR real effective exchange rate is elevated, so further appreciation looks limited. But with the RBI having the best FX reserve adequacy in the region, there is scope to prevent excessive volatility in the INR, the report added.

Meanwhile, it is imperative to sustain the ongoing pace of reforms, especially till the ruling party’s term ends in 2019. However, markets may react adversely to the upcoming state elections scheduled to be held next year, which could disturb the country’s growing spree.

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock