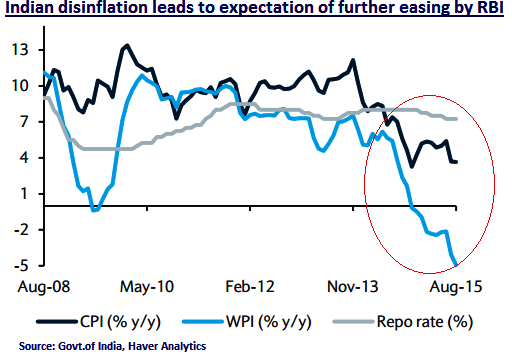

Strong disinflation opens room for further RBI easing, the disinflation in India has been strong and broad-based since H2 2014, reflecting markedly better food price management, sustained idle industrial capacity, lower commodity prices and a largely stable INR.

We expect retail inflation (CPI) to average 5% during FY 15-16, considerably lower than the central bank's early 2016 target of 6% and the long-term (15- year) average of 7.3%.

Disinflation has been even stronger at the wholesale price (WPI) level, which has contracted on y/y basis in every month since November 2014 and is currently near a four-decade low (August 2015: -5.0% y/y).

The renewed weakness in commodity prices in Q3 15 should help keep inflation 'lower for longer'. Despite stronger GDP prints under the 'new' series, we see little sign of demand-driven inflation.

Such rapid disinflation allowed the Reserve Bank of India (RBI) to cut the repo rate by 75 bps during H1 15. We look ahead to the central bank to cut the repo rate another 25 bps in H2-15, likely in its policy meeting scheduled for tomorrow.

What are market participants expecting from tomorrow's policy?

According to Bloomberg Survey of 49 analysts, 41 expect a repo rate cut and 8 expect no change in the RBI's stance on the interest rate. Our expectation is also of a 25 basis point cut in the benchmark repo rate. SLR and CRR are expected to remain unchanged.

Indian disinflation leads pressures on RBI easing

Monday, September 28, 2015 12:46 PM UTC

Editor's Picks

- Market Data

Most Popular

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady